Today, we’re excited to introduce the Institution Connectivity Dashboard—a new tool that lets you instantly check how well Monarch connects to your financial institutions.

While the broader financial ecosystem presents challenges to stable connectivity—ranging from bank-side restrictions to limitations with data providers—we are doing everything we can to deliver the most stable and seamless experience possible. While much of this work happens behind the scenes, today we’re making it more visible.

The Institution Connectivity Dashboard is a big step in that direction: it brings transparency to connection performance and gives you the clarity you need to make informed decisions.

From internal metrics to a member-first tool

While working on improving connectivity behind the scenes, we created a series of “health metrics” to help us measure and improve performance across providers (like Plaid, Finicity, and MX) and institutions (for example, Chase, Bank of America, etc). How do we generate these metrics? We look at, in aggregate, how connections are performing from Monarch to each underlying institution through each data provider. This allows us to better understand how best to connect to each institution, detect when problems arise, and provide information to our members when things go wrong.

Over time, it became clear that this information could be just as valuable to our members as it was to us—and even help spark broader change in the industry.

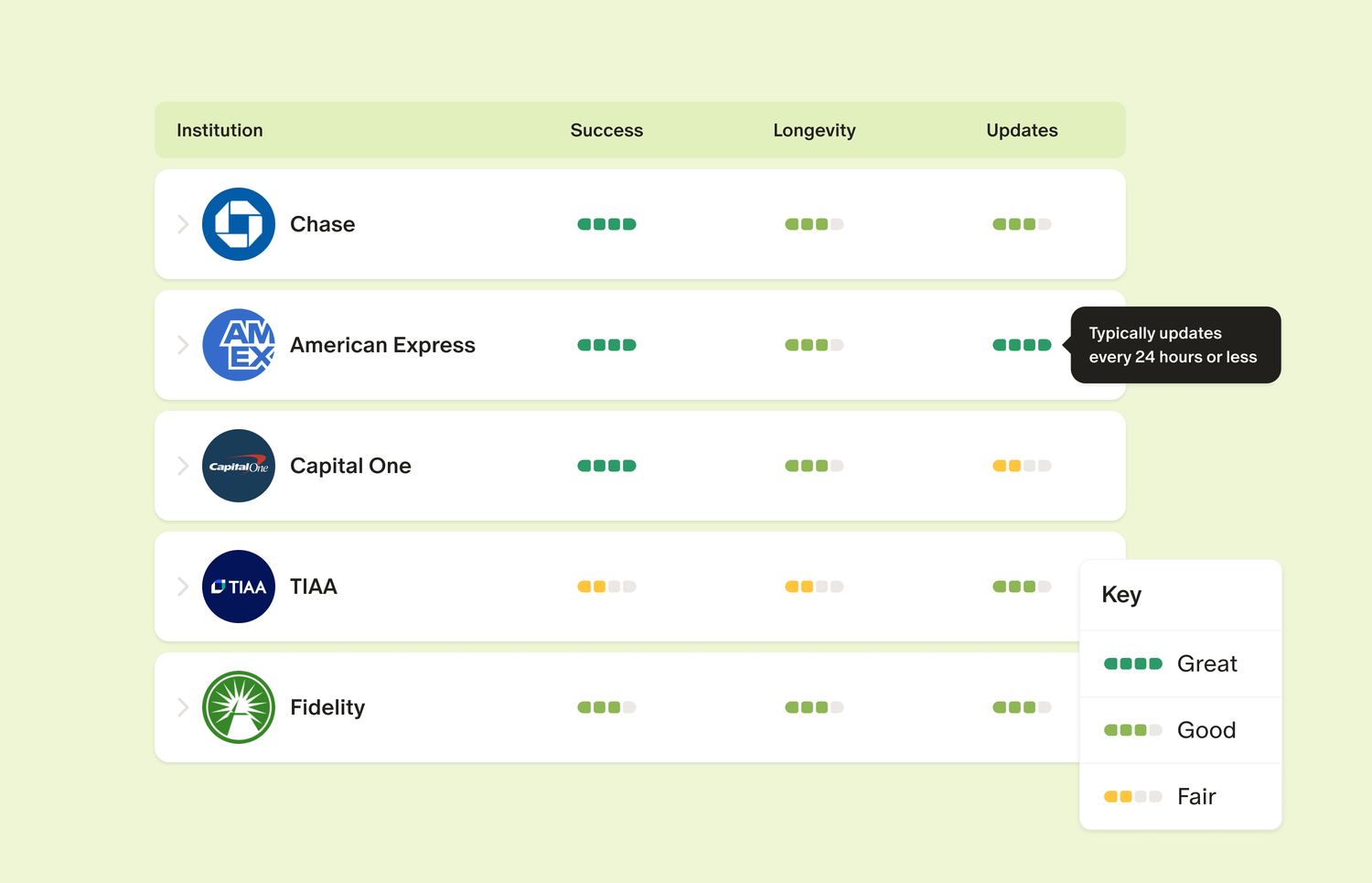

We believe in putting members first, simplifying complex issues as much as possible, and always being transparent. The Institution Connectivity Dashboard manifests those values by providing a clear view of connection quality across three key areas:

- Initial Connection Success – Likelihood of successfully linking your account through a specific data provider.

- Connection Longevity – How long a connection typically stays active before requiring reauthentication or another action.

- Average Update Time – How frequently Monarch pulls in new data, helping keep your financial picture up-to-date.

The dashboard also supports:

- Connection Popularity – How often a financial institution is linked within Monarch (sorted by most popular first).

- Internal Notes – Any known insights or updates about a specific institution’s connection status.

Why this matters

The dashboard is intended to help both prospective users and current members in meaningful ways:

- Allowing users to make informed decisions before signing up by checking how well Monarch connects to their financial institutions.

- Providing current members insight into connection reliability and help them understand whether an issue is specific to their account or more widespread.

- Enabling current Monarch members to decide whether they will have a better experience by switching to a different data provider.

- Generating industry-wide improvements by promoting visibility into connectivity performance across Monarch and platforms like it, data partners, and financial institutions.

What’s next?

This is just the beginning. In the near future, we’ll bring these metrics into the Monarch product itself—so if you ever experience a connection issue, you’ll have helpful context right where you need it. We’ll also do our best to help you understand what’s going on when your individual account connectivity doesn’t match with what’s expected for that institution and what other members are experiencing.

We’re also planning to add features like historical connection trends, real-time outage alerts, and easier ways to report issues. We will also continue to improve on and expand these metrics; they aren’t perfect, and may not capture all possible issues today, but the more eyes we have on them, the easier it will be to improve them. With the initial debut of this dashboard, we’re excited to get your feedback and to learn other ways in which you would find the information to be useful.

Reliable bank connectivity is critical to getting the most out of Monarch. That’s why we’ve built a dedicated team focused entirely on improving it. We continue to work on improving connectivity more broadly, as well as building tools to help understand and fix issues when they arise.

Connecting to over 13,000 financial institutions is no small task, but our goal is simple: to make it feel effortless for you. The Institution Connectivity Dashboard is another step forward—providing transparency, accountability, and continuous improvement so we can simplify managing money, together.