What’s New

We're always working on new features and improvements. Check back here for the latest updates to Monarch.

August 14, 2025

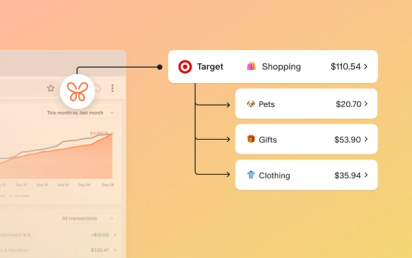

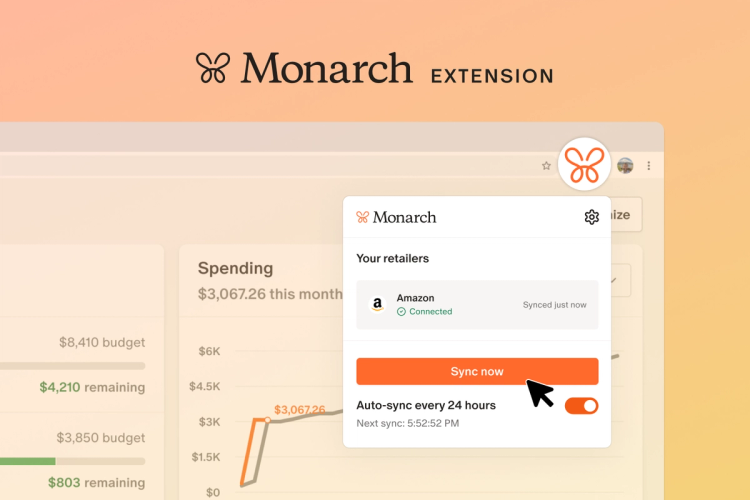

The Monarch Extension, now supporting Target

The Monarch Extension now supports your Target shopping trips, a new way to track your credit health in Monarch, and more.

July 9, 2025

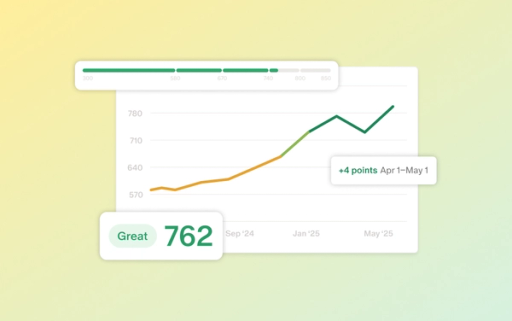

Your credit score, now in Monarch

From tracking your credit score to customizing notifications and moving through the app faster than ever, there's a whole lot of newness to explore in Monarch.

July 16, 2025

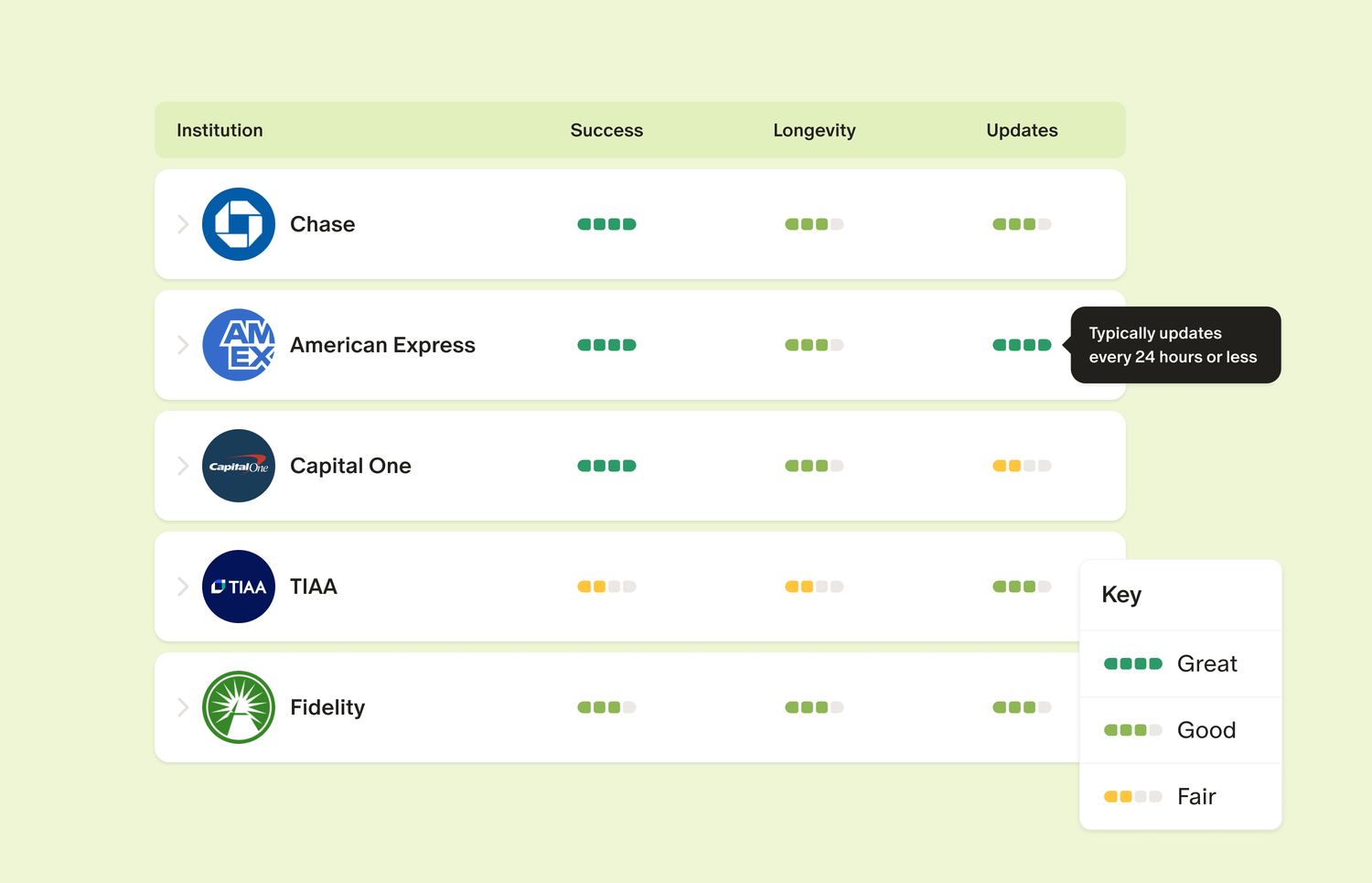

A new level of clarity for bank connectivity

Our new dashboard brings transparency to account connection health metrics, updated daily.

May 23, 2025

Announcing Monarch’s $75M Series B financing

This capital will accelerate our mission of bringing financial wellness to the masses.

May 6, 2025

Your Amazon orders, perfectly categorized

The new Monarch Extension syncs with your Amazon orders to accurately categorize and split transactions—automatically.

February 26, 2025

Your favorite reports, now one click away

Now you can save your favorite reports for quick access. Plus a number of other improvements!

December 12, 2024

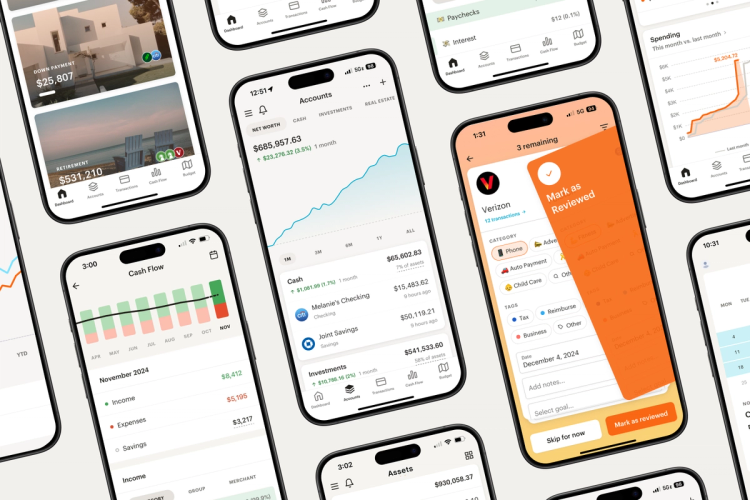

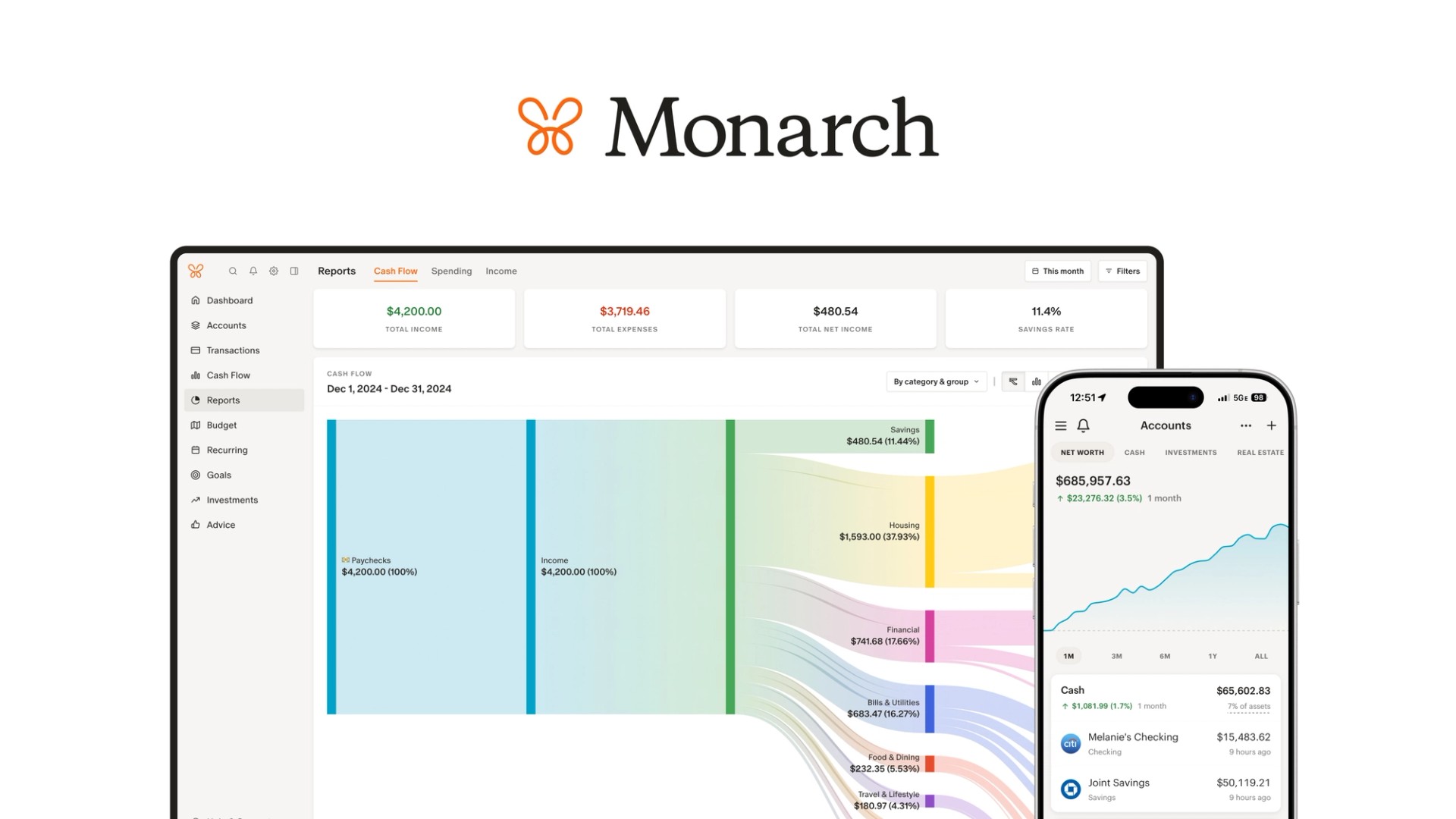

Monarch's Refreshed Look & Product Updates

Today we rolled out Monarch’s new look along with product updates to make managing your money even easier.

November 1, 2024

Introducing Bill Sync

Track statement balances, minimum due and payments made on your credit cards and loans, all within Monarch.

October 24, 2024

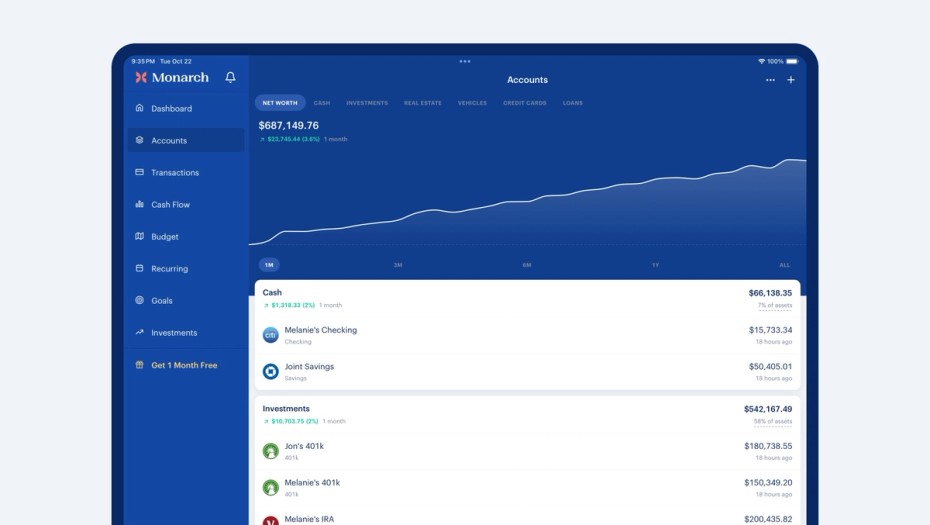

iPad support, Budget enhancements and more

Full iPad support is here! Plus, you can now customize your mobile app navigation, track your budget more visually, and more.

August 13, 2024

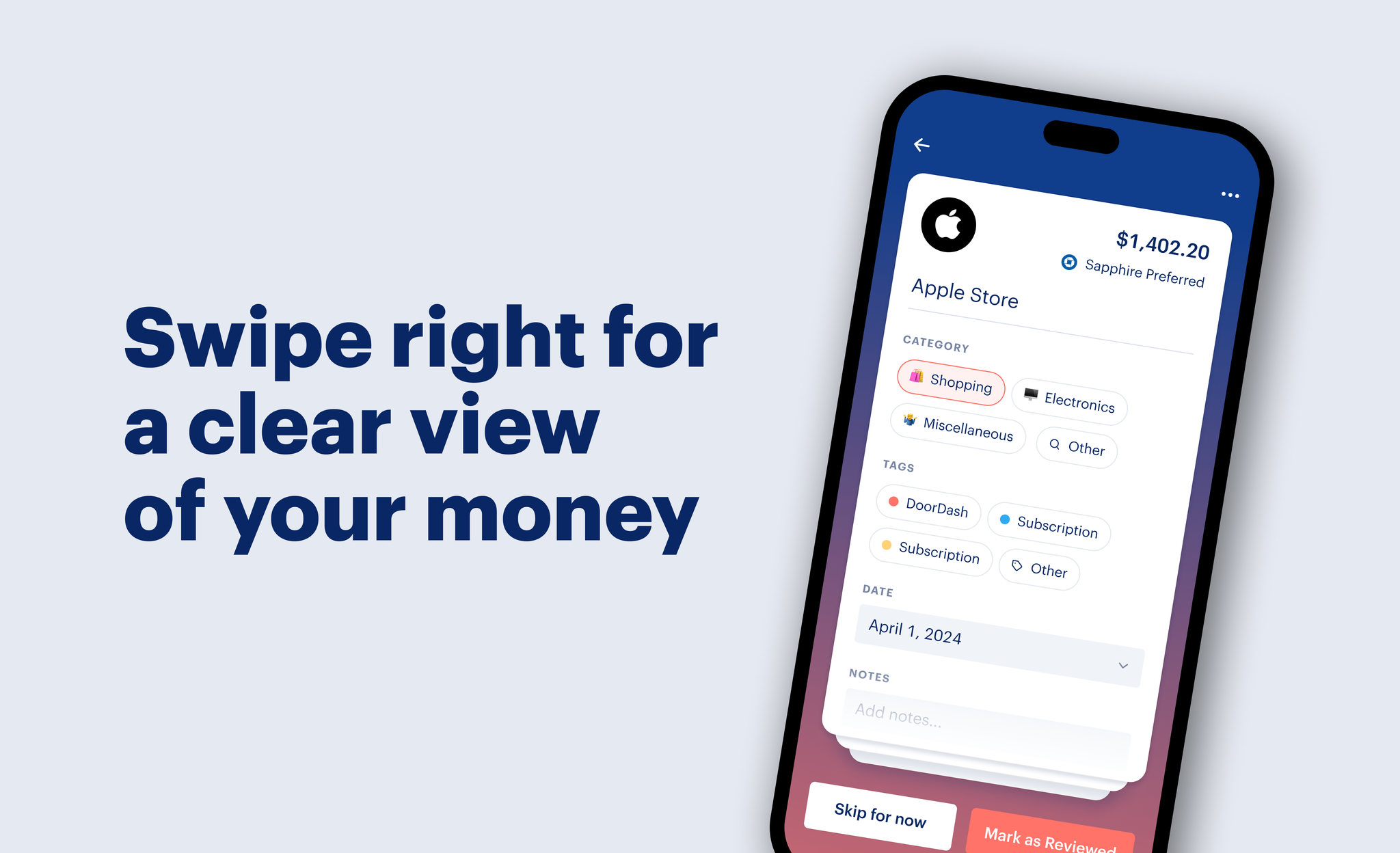

Review faster than ever, and split transactions automatically

We’ve dropped new enhancements that help make reviewing transactions 2x faster (and more fun). Plus, automatic transaction splitting is here!