We started Monarch with the belief that we could build a better money system that goes beyond just having a budget. Although many of us on the team have used zero based budgeting in the past, we wanted a system that could forecast future cash flow, track monthly savings rate, and keep tabs on investments in addition to budgeting.

Budgets are an important part of managing your money, but we believe budgeting should help you focus on planning for your future, not just tracking every dollar in your past.

Zero Based Budgets

This type of budgeting system came to be popular in the 1970’s and was used by businesses to set corporate department budgets (Wikipedia). Zero-based budgets are great when expenses are regularly higher than income causing you to add (credit card) debt to pay for everyday living. These type of budgets force you to make hard decisions by accounting for every dollar as part of setting up a budget.

The name "zero-based" comes from the idea that every budget category starts with $0 and you have to assign a "job" for every dollar when it goes into a category. Those jobs start with money you already have sitting in a bank account, and then you can assign a job to new money as it comes in. But you are always working to react to money after you receive it.

If you spend more than you earn, this system works well since it forces you to look at all your money, both in the accounts you have already and what you expect to come in the near future. Since every dollar has to be accounted for, you can see exactly how everything adds up.

We believe that most people who earn more income than they spend will find this zero dollar approach clunky. It just takes too much manual effort without much benefit. They force you to spend more time tracking the past instead of planning for the future. We think you can use your time better by optimizing and tracking your savings with your goals, not accounting for every dollar in the past.

Monarch Budgets

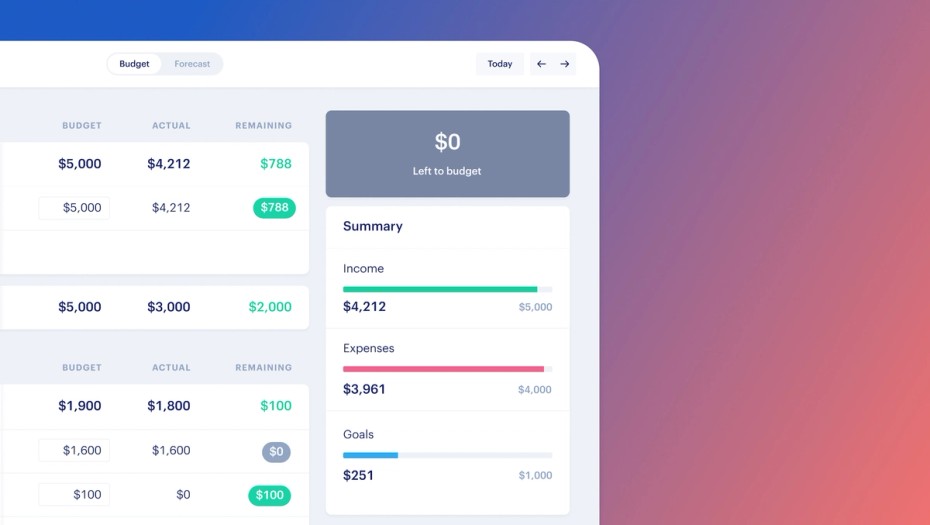

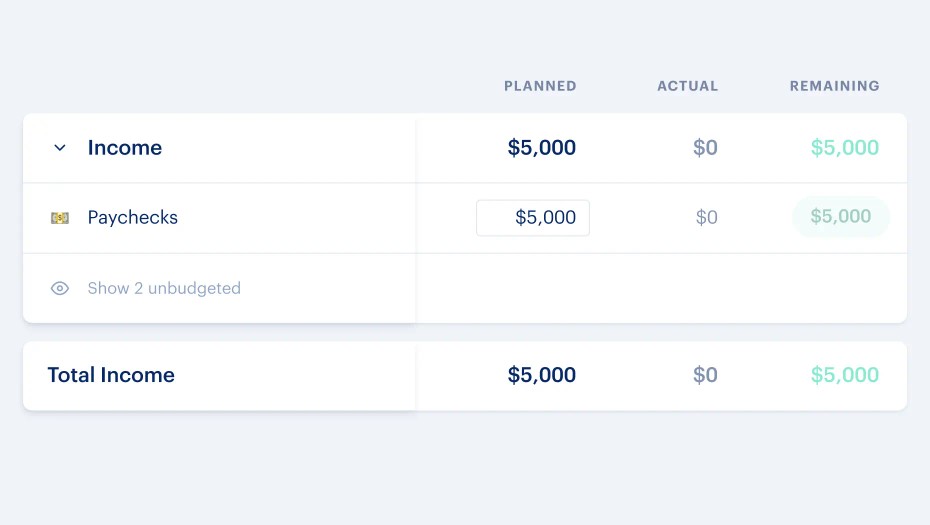

Monarch budgets are built around how much income you expect to receive in a month and how much you expect to spend of that income. The tracking of budgets is always framed around income vs expense. Budgets in Monarch don't look at your current account balances since they are based on cash flow. Your income is organized between the two things you can do with it: spend it (expense) or save it (goal). By looking forward to future income and giving a job to those future dollars before they come in, it’s a more proactive way to budget than budgeting off of account balances.

That means that Monarch is built assuming that you are cash flow positive (ie you earn more than you spend in a typical month). We are focused on budgeting from income and not bank accounts because we believe the best point in time to plan what to do with your money is before you receive it, not once it’s sitting in a bank account.

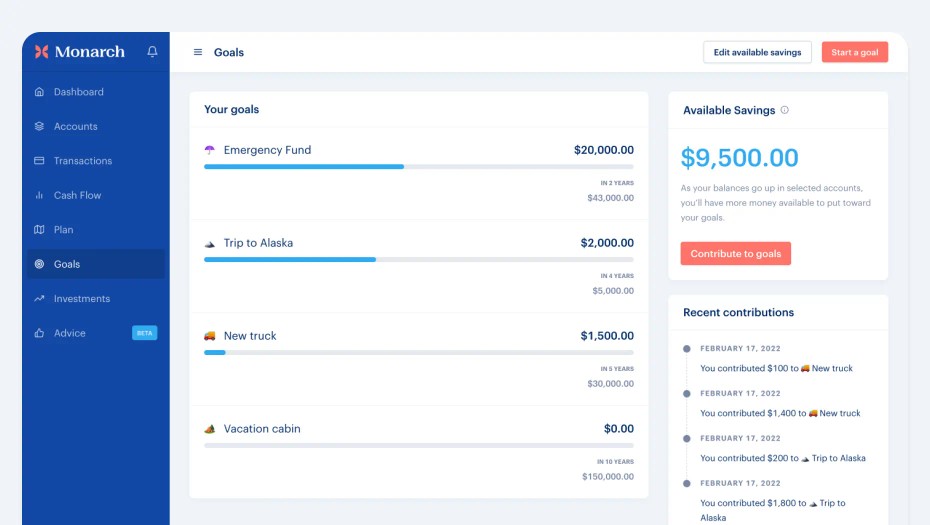

Goals

But there is still money that is unbudgeted in checking or savings accounts. Monarch lets you assign balances to goals so that you can give the job of a goal to your existing account balances. Then when you set a budget for the upcoming month you can earmark a certain amount of savings towards those goals.

Monarch also includes advice on what goals you might want to have. There are some common ones like saving for a down payment on a home, setting up an emergency fund, or just general open ended savings. We’re still early in our plans for building advice and planning to help with goals so expect to see more here in the future.

How to Budget with Monarch

There are several ways you can set up a budget in Monarch. We think the best budget is one that works for you but here are 3 methods you can use:

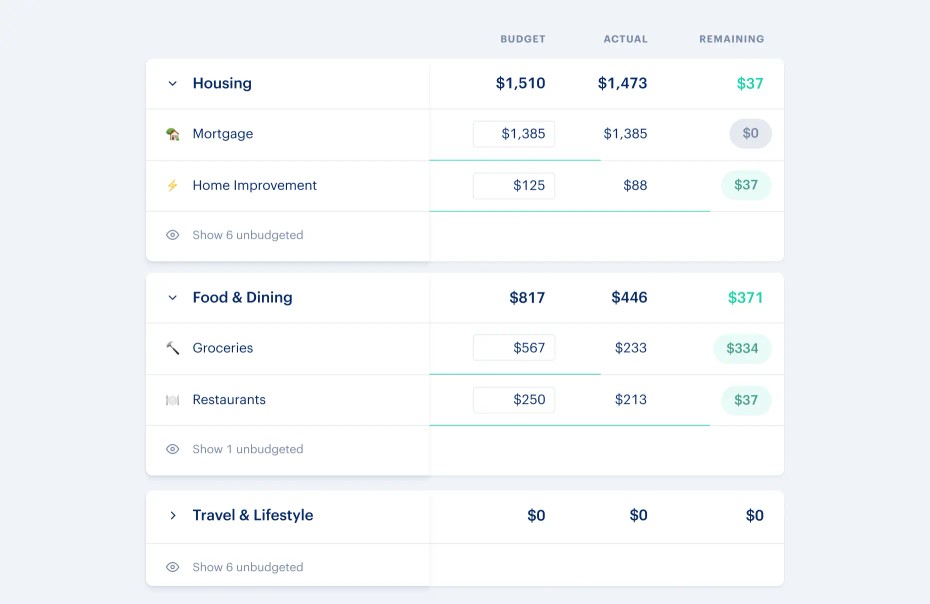

1. Budget Using Groups & Categories

This is the most common way to budget and it's the default experience when you first try budgeting in Monarch. There are 14 expense groups to start:

- Auto & Transport

- Bills & Utilities

- Business

- Children

- Education

- Financial

- Food & Dining

- Gifts & Donations

- Health & Wellness

- Housing

- Shopping

- Taxes

- Travel & Lifestyle

- Other

You can turn a few of these groups off if they don’t apply to you. For example if you don’t own a business you probably don’t need that group. Or if you don’t have kids you can disable the Children group.

Each of these groups have 3-5 categories which is where the actual budgets are set. By grouping them into thses broader groupings it's easier to track since you can watch 10 groups instead of 50+ detailed categories. Budgets at the group level are simply the sum of all the category budgets in that group.

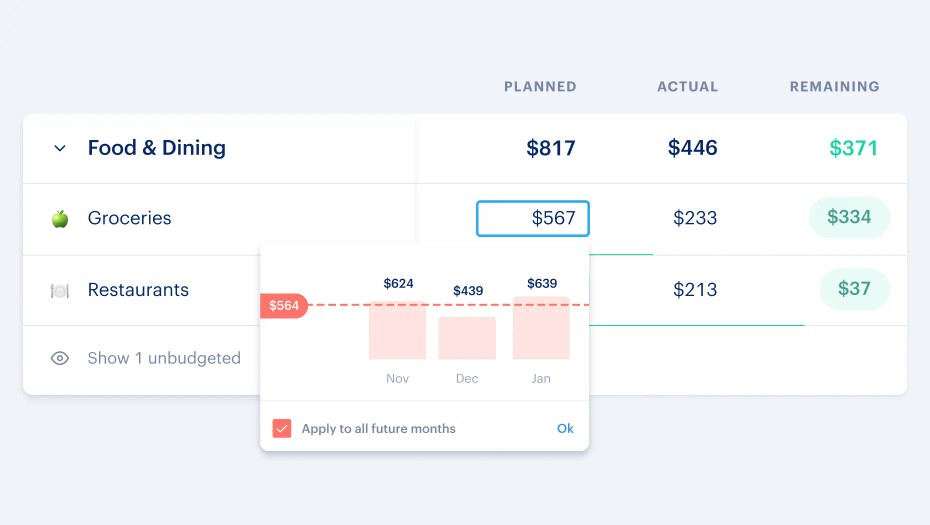

When trying to decide how much to set for a budget, Monarch will make an estimate using an average from the last 3 months in that category. This is particularly helpful if you click the budget amount each month to see if your 3 month average is trending up or down. The bar graph and ability to fill the budget amount is one of the most popular budget features in Monarch since it doesn’t force you to do calculations or estimations for your budget. 1 click will let you set a budget based on the average from the last 3 months.

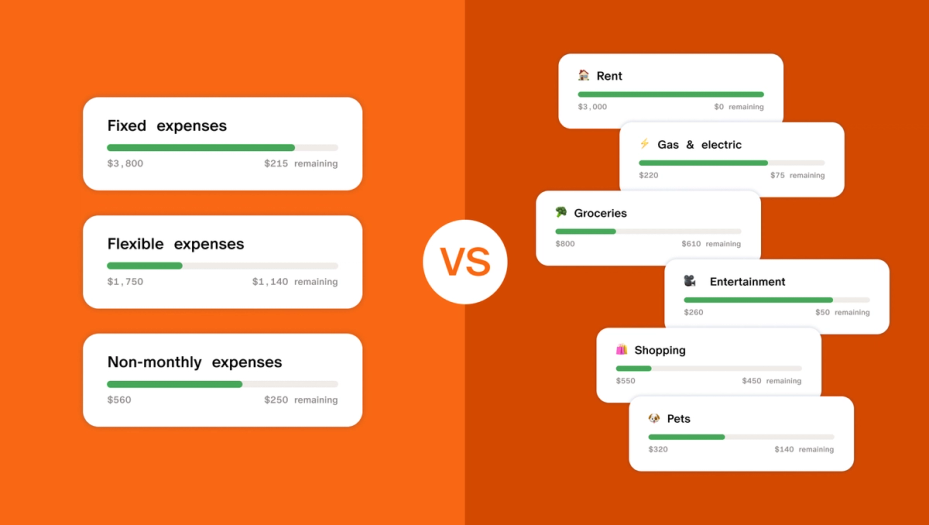

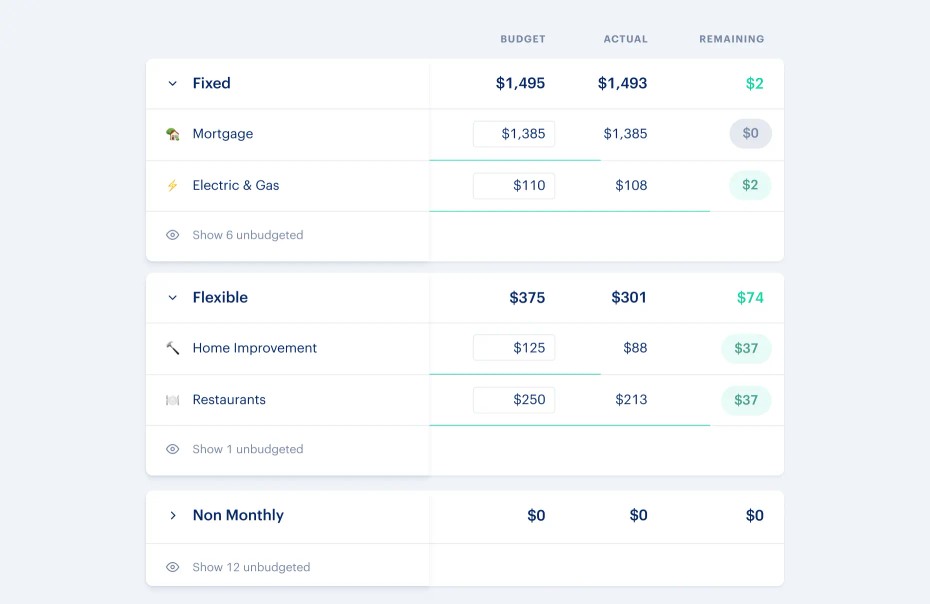

2. Budget Based on How Money Flows

Another great budgeting method is to create 3 groups based on how money flows:

- Monthly Fixed

- Non-monthly

- Flexible Spending

This approach starts by budgeting the monthly “fixed” expenses where you know the amount in advance. This is helpful since you don’t need to make an active in-the-moment spending decision for these budgets. They are the bills that are on auto-pay already. Think of things like your mortgage or rent, utilities, streaming music or TV services etc. By subtracting the fixed monthly expenses from your income you no longer have to worry about them and are left with a pool of money where you have more day-to-day decision making.

The next group is for any large non-monthly budgets. Big things like vacations, property taxes, yearly subscriptions, summer camp, tuition are all types of budgets that are non-monthly. Using the Plan Forecast you can put these future expenses in the months they will happen if you want to cover them with income from the month they are due. Or if you wish to budget to save up for them you can make the category a rollover and allocate a part of your budget each month leading up to the non-monthly expense.

The last budget group is called “flexible spending” which is completely up to you on how you want to track things. We’ve heard some people leave their flexible group as unbudgeted and it’s just whatever income is left after fixed and non-monthly’s. Other people like to keep a 3-month average in their account balances and budget their remaining flexible spending to reach a balanced income vs expense budget each month. The neat thing about “flexible spending” is that if fixed expenses are on auto-pilot and non-monthlies are planned for, this is the only budget group you need to focus on for day-to-day spending. It can be your “safe to spend” number and can be liberating since you don’t have to budget every single dollar within it.

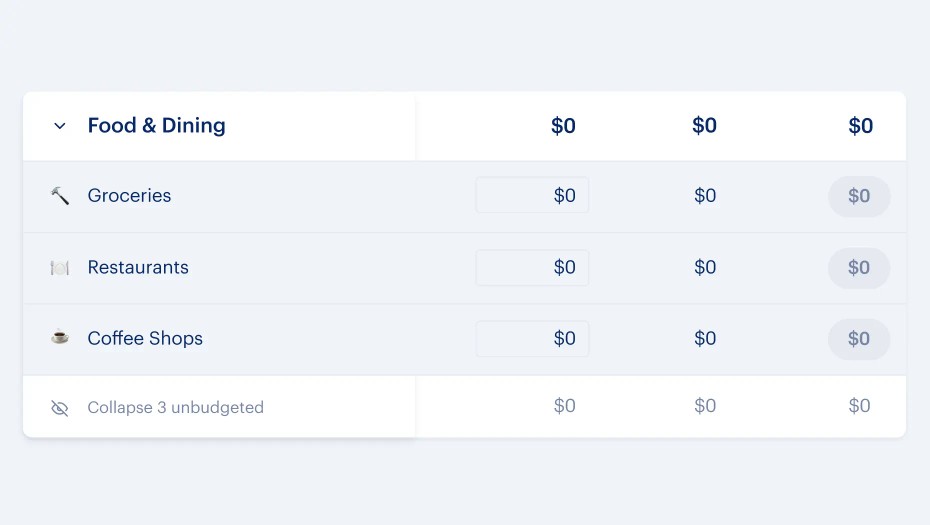

3. Don’t Budget

The last budgeting method we hear about from Monarch subscribers is not having a budget at all. They simply track their cash flow - income = expenses vs savings. You can still track spending by category without having a budget so this can be a handy way to watch where you spend without setting up a budget. In fact, if you set the budget to $0 it is hidden from the plan while you can still categorize transactions.

If you are tracking cash flow (with or without a budget) there are two particularly helpful features - your saving rate percent and the trend of this month's expenses vs last months. Both of these are great ways to track your spending without a budget:

Credit Card Payments

Monarch has a category type called “Transfers”. Any transactions categorized as a transfer do not count towards your budget or show up in your cash flow since it is considered money that is moving between accounts. No new money is coming in or going out. Credit card payments by default are considered transfers which mean they won’t show up in your budget or your cash flow. That’s because Monarch budgets your credit card spending in real time as new charges are put on the card, not when the monthly credit card bill is due.

This goes back to the budgeting concept of helping you make more proactive decisions since Monarch budgets are tracking spending in real-time well before a credit card payment is due. For this approach, we recommend keeping a 2 month cash buffer in the checking account that auto-pays the credit card to ensure there is enough cash to make payments.

This is a different approach from zero-based budgets that try to match your credit card payment to exactly how much you have sitting in your bank account at any moment. But by tracking spending in real-time you have more information before a bill is due. Once the credit card payment is due your spending is already decided and it’s just a bill that needs to be paid.

Go Beyond Budgets, with Monarch

We hope this helps explain how you might start to budget with Monarch. There are many more features beyond budgets so the best way to see everything is to start a free trial. And if you found this helpful drop us a note at support@monarchmoney.com to let us know what you think we should write about next!