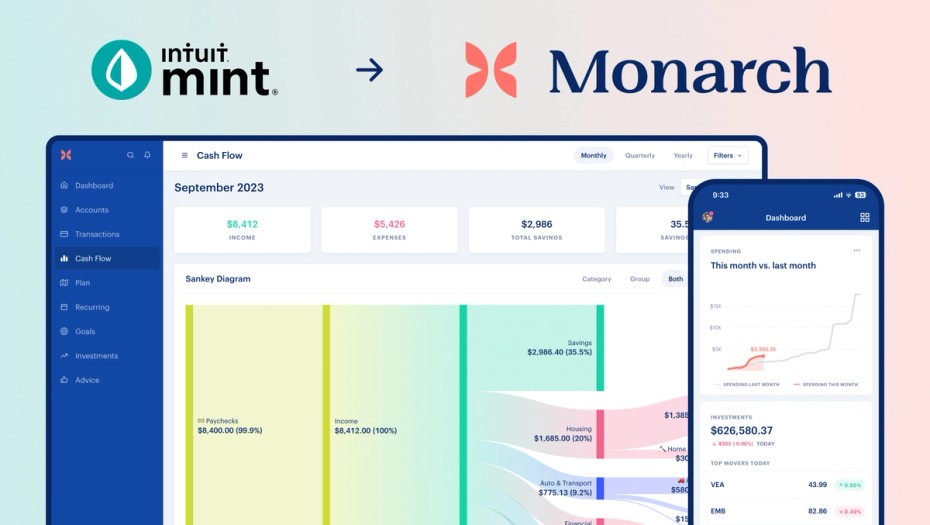

Intuit just announced that they will be shutting down Mint, the popular personal finance app, by January 1st, 2024. They are asking Mint users to use Credit Karma (also owned by Intuit) to manage their finances instead. This has created an uproar in Mint’s Reddit community.

Mint has been around for over 15 years and many users have many years of financial history stored in the app. Moreover, this article from Intuit’s help center states that some key personal finance features such as budgeting will not be available in the Credit Karma app, so it’s understandable why users are so upset.

As the first product manager on the original team that built Mint, as well as the Co-founder and CEO of Monarch (a subscription-based personal finance app) I have now been in the personal finance space for over 15 years and have seen first-hand the benefits (and challenges) that these apps can provide across millions of users. I wanted to share my (admittedly biased) perspective on what Mint users should consider going forward.

My history with Mint

This news is bittersweet. As mentioned, I was the first product manager on the original Mint team and helped steer the direction of the product from its early days through its acquisition by Intuit in 2010. I’ve always been proud that we created a product that has helped so many people better manage their financial lives, and the prospect of Mint getting shut down is a little sad.

At the same time, it’s not a surprise. A free personal finance app is simply not a viable business.

Most free apps in the app store have minimal direct costs associated with delivering their service. This is not the case with personal finance apps, which typically rely on data aggregators (Plaid, Finicity, etc) to connect to tens of thousands of financial institutions to aggregate the necessary financial data. These data fees are quite expensive, which means a personal finance app is losing money on each free user and must make it up in some other manner.

Mint’s business model was to present users with offers for various financial products (banks, credit cards, etc) and to earn a referral fee if a user applied for one of those products. Unfortunately, this model was never able to cover our data costs of delivering the service. Worse still, this ad-based business model created misaligned incentives between the company and its users, because the financial products that offered the highest referral fees were typically not the objectively “best” products for our customers. There was always an internal tension between doing what was in our users’ best interests and trying to drive revenue to keep the business alive.

It eventually became clear that we would either need to change our business model or sell to a larger company. Intuit came knocking right at that time, which is how the acquisition happened. The thinking was that Intuit could offset Mint’s losses by using it to funnel more users into TurboTax, which is a massive revenue driver for Intuit. Candidly, I (and much of the original Mint team) became disillusioned with this direction and left Intuit shortly after the acquisition. That said, it clearly made strategic sense for Intuit, as evidenced by the fact that they have kept Mint alive for the past 13 years.

Of course, Intuit purchased Credit Karma in 2020. Credit Karma has an estimated user base of 130M US users, so it’s a much larger platform for cross-selling Intuit products such as TurboTax, as well as Credit Karma’s bread and butter which is loans, credit cards, etc. If you're Intuit, it doesn’t make sense to keep investing in both of these consumer platforms, so I’m not surprised they’re shutting Mint down and consolidating on Credit Karma.

What should Mint users do now?

After 25 years in the technology industry, I’ve seen firsthand how a company eventually becomes its business model. Google is no longer a search company, but an advertising company. Facebook is no longer a social network, but an advertising company. Similarly, Mint and Credit Karma are no longer personal finance companies, but advertising companies.

If you’re an existing Mint user and wondering how you should best manage your finances going forward, I would strongly encourage you to consider a subscription-based personal finance app instead of a free one.

A subscription-based app:

- Aligns company interests with your interests. It’s hard to overstate the importance of this. When you are paying for the service, you are the customer. You call the shots, and the company builds what you want and need. If it doesn’t, you cancel your subscription. This aligns incentives and ultimately leads to a much better user experience. The opposite is true in a free service, where ultimately the advertiser is the customer as they are the ones paying the bills.

- Provides better data connectivity. Personal finance apps are only as useful as their underlying data. As mentioned above, keeping this data up-to-date is a massive and expensive challenge that everyone underestimates. Subscription-based services are incentivized to constantly invest in this data architecture; otherwise, customers churn. Free services can’t invest the same amount in this data quality and are typically plagued by poor institution coverage and broken connections, leading to stale data and a frustrating (or misleading) user experience.

- Protects your privacy. Your financial data is extremely sensitive. It’s also extremely valuable to advertisers. Do you really want this data being sold to advertisers and other data brokers? As the saying goes: “If you’re not paying for the product, you are the product.”

- Is a more sustainable business. If you’re investing a lot of time learning and setting up a new personal finance app, you want that app to stay around for a long time and continue to improve, not stagnate from lack of development, or go out of business because they ran out of money. The subscription model provides a higher chance of a company staying around long term.

When you combine all of the above, I firmly believe that when it comes to personal finance apps, the subscription model provides both a better user experience and ultimately better financial outcomes for you and your family. Based on my experience building both Mint and Monarch, I’ve seen thousands of examples of the dramatic impact that good financial behavior can have on improving one’s financial health, reducing stress, and helping you achieve your financial goals. If you’re interested in improving your financial situation, in my opinion, it’s a no-brainer to pay a few dollars per month for this benefit.

Why Monarch?

Hopefully, I’ve convinced you to consider a subscription-based personal finance app. Luckily, several good solutions have launched in the past few years and I encourage you to check them out.

As the co-founder and CEO of Monarch, I am obviously biased and hope at the end of the day you choose to give us a try. To that end, I want to share some of the things that I believe make us unique:

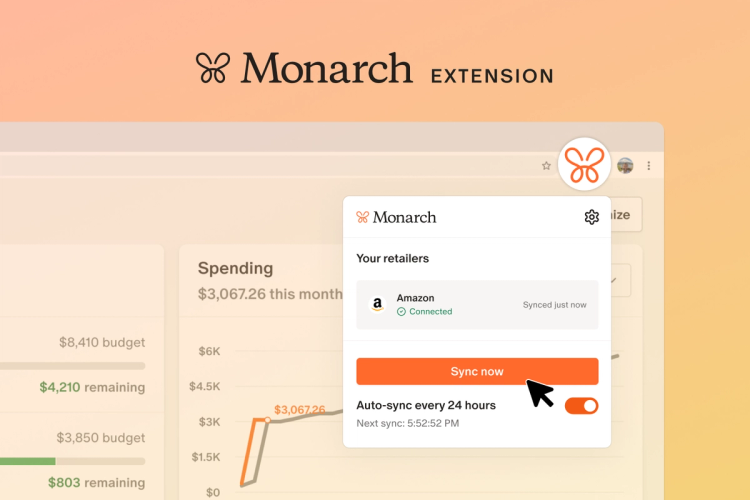

- Best data connectivity. Unfortunately, no single data aggregator provides complete coverage of all financial institutions. So we have integrated with all of them at Monarch. What’s more, we’ve spent years (and millions of dollars) building an intelligent data infrastructure that can route users to the best aggregator for a given financial institution. We’ve also invested heavily in AI-based transaction cleansing and classification. I believe we have the best financial data infrastructure that has ever been built for this use case. In full transparency, this is an ever-shifting landscape and there are still a few large institutions that don’t want to share their data, so our coverage is not yet 100%. We plan to get there eventually!

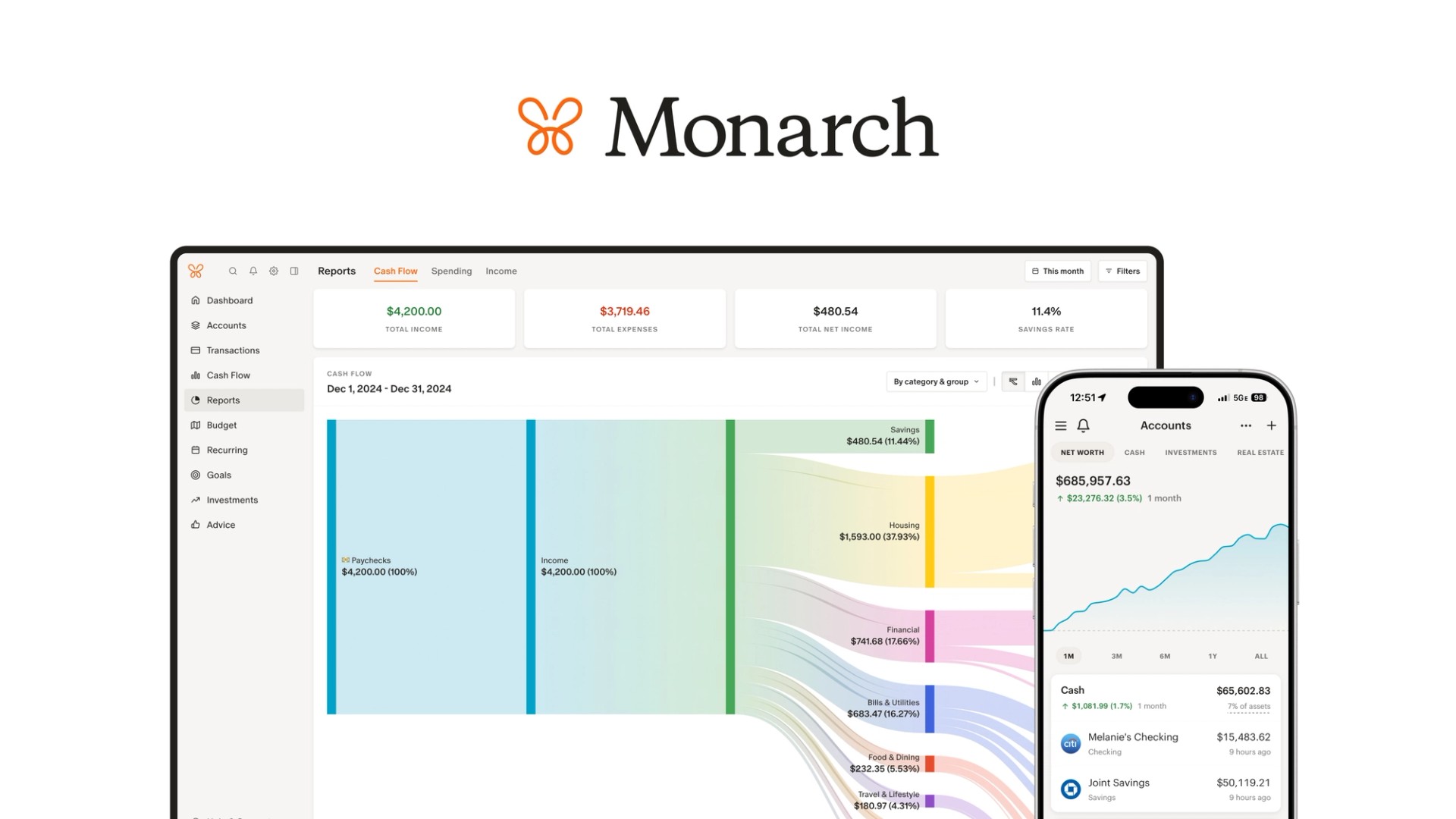

- Go beyond budgeting to financial planning. While it’s very helpful to track your budget, cash flow, and net worth over time, Monarch goes one step further to help you plan your financial future with goals and forecasts. At the end of the day, the whole point of managing your finances is to achieve better financial outcomes, which involves planning for your future and not just looking at the past. We will have some exciting announcements on this front soon!

- Import your Mint data and preserve your history! Monarch offers the ability to import your Mint data and preserve your history! You can learn more about how to do this here.

- Customer-driven rapid development. We are customer-obsessed! We constantly solicit customer input through multiple channels and hold user interviews to better understand people’s needs and ensure we’re building the highest impact items. We are rapidly improving the product, typically releasing a new version of the app every few days. You can see some of the recent highlights here.

- Monarch is multiplayer. We designed Monarch to be multi-user from the outset. So you can collaborate with your partner or spouse around your financial goals. A lot of Monarch users are also using it with their accountants or financial advisors in order to keep everyone on the same page.

- Available on web, iOS, and Android. Monarch has apps available on all of the major platforms.

- Actual customer service! If you have a problem, you can contact our CS team. They’re real people! And they will send you a real response, typically within 24 hours.

- Mission-driven team and investors. I would be remiss if I didn’t mention that we have a very seasoned team that is mission-driven to help American households improve their financial lives. We have also raised $20M from world-class investors to tackle this problem, and we’re just getting started.

Monarch is free to try, and quick to set up

Monarch is free to try for 7 days, and after that, the subscription price is $14.99 per month or just over $8 a month if you sign up for our annual membership ($99.99 per year). You can learn more about Monarch’s features here or sign up for a free trial here.

Whatever you decide to do, we wish you the best in your financial journey!