You may have heard that zero-based budgeting can help you manage your money by helping you account for every dollar. Some people swear by this approach, but it’s not without its downsides.

Let’s break down zero-based budgeting, with how-tos and examples, so you can decide whether it’s the right budgeting technique for you.

What Is Zero-Based Budgeting (ZBB)?

Zero-based budgeting is a budget style where your total income minus saving and spending equals zero. ZBB assigns a specific purpose to every dollar that comes in. With this method, you’ll justify and track each expense. This is a highly precise method of budgeting that sacrifices flexibility.

A Brief History of ZBB

Author Peter Pyhrr created zero-based budgeting in the 1960s. Also known as zero-dollar budgeting, he developed it for business use while working as a manager at Texas Instruments in Dallas. Radio personality Dave Ramsey later popularized the method for personal use.

How Is Zero-Based Budgeting Different?

Zero-based budgeting assigns a job to every dollar in your take-home pay. Rather than planning for your income, it’s a reactionary approach that waits for a deposit, then tasks you with manually deciding where the money should go. It’s a hands-on, tedious approach that makes it more difficult to stick to a budget.

Natalie Taylor, CFP, points out that zero-based budgeting can work for those who spend more than they make. “However, it takes a lot of work to allocate each dollar every month.”

How to Use a Zero-Based Budget

To create a zero-based budget, start with the amount of money in your paycheck. Then split your check into your different budget categories.

Say you take home $3,500 every week from your paycheck. With a zero-based budgeting approach, you would allocate the money to the most pressing budget items. This week, those might be:

- $2,000 to your mortgage

- $300 for daycare

- $200 for groceries

- $300 for savings

- $300 for utilities

That leaves you with $400 to allocate to other budget categories.

In other words, zero-based budgeting turns every dollar into a “task.” Money that’s “left over” isn’t a bonus — it’s another sum you need to allocate. Then when your next paycheck hits, the process starts again.

As you can see, this approach can be difficult in its absoluteness. While it can minimize overspending, the frequent calculations can be overwhelming.

Pro Tip:If you do decide to use zero-based budgeting, don’t forget that “having fun” is a legitimate budget category. This can add a little flexibility to the otherwise restrictive ZBB approach.

Pros and Cons of Zero-Based Budgeting

Zero-based budgeting isn’t for everyone. It’s generally best if you’re struggling to stop overspending. Looking at the pros and cons can help you decide if ZBB is right for you.

Pros:

- Accounts for every dollar you spend

- May help you pay down debt

Cons:

- Inflexible

- Doesn’t help you plan ahead

- Takes a lot of work

- Easy to go off track

Pro Tip: With an inflexible budget like ZBB, as soon as you do one thing that doesn’t fit, the whole thing collapses. You’ll need to revisit ZBB with every paycheck, vs a more flexible approach like the Monarch Money app that you can set and forget.

Alternatives to Zero-Based Budgeting

Besides zero-based budgeting, there are a few other popular budgeting styles to consider.

- 50/30/20: The 50/30/20 rule allocates 50% of your income for needs, 30% for wants, and the remaining 20% for savings. It offers a more balanced approach than ZBB.

- Reverse budgeting. With this method, you save and invest your money first, then spend the rest.

- Envelope system. This budgeting technique uses cash and envelopes to track spending. It’s best for people on tight budgets who habitually overspend.

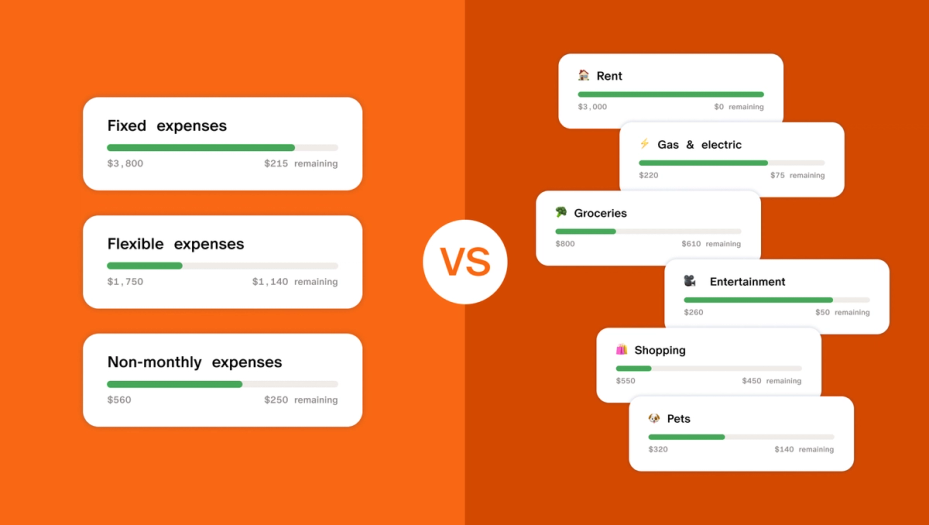

- Monarch Money app. This app lets you create a flexible budget that changes as your situation does. It can track your expenses and savings across multiple accounts.

Zero-Based Budgeting | Monarch Money App |

Tracks every dollar as it comes in | Plans for future income and expenses |

Every expense must be justified | Lets you track, plan, and spend as you need to |

Requires considerable effort | Is easy to use |

Works well for overspenders | Is flexible enough to support a variety of financial situations |

The Monarch Money app gives you a flexible way to budget. While zero-based budgeting can be effective for certain people, the amount of effort required can make it less likely that you’ll keep using it. ZBB digs into the minutiae of every cent, but most people would rather spend the time and effort elsewhere.

Summary: Is Zero-Based Budgeting Right for You?

Zero-based budgeting is rigid in its approach and requires considerable time and effort. A good alternative to ZBB is to plan for your expenses and income in advance. By setting goals, monitoring your cash flow, and being prepared for unexpected costs, you can enjoy a healthy and well-rounded relationship with money.

Subscribe to our financial newsletterSign up with your email to receive all our latest blog posts directly in your inbox.Subscribe