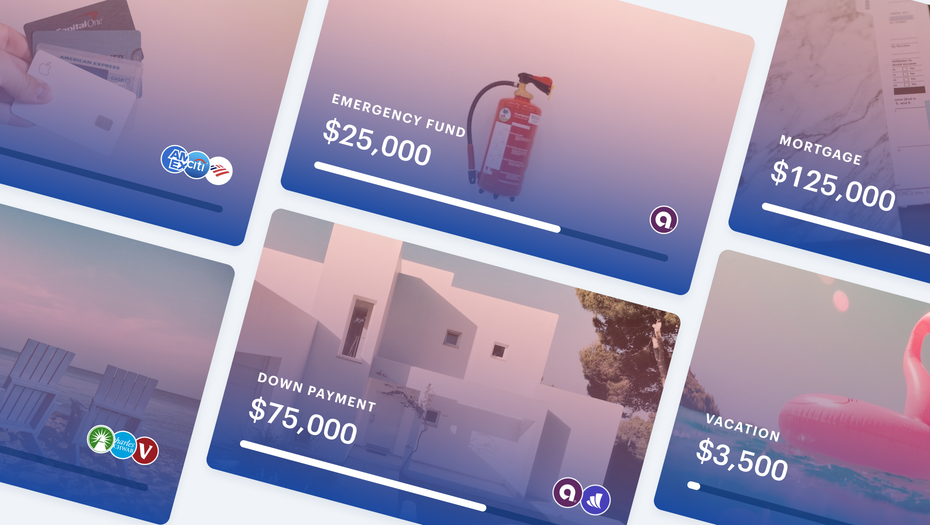

We’ve been hard at work on a new goals experience, and this week we launched the first iteration of it on web, iPhone, and Android! Check out the video below for a brief preview of the feature.

How it works

You can now assign your accounts to a specific goal to automatically track your progress as your account balances change. You can also split an account's balance and assign it to multiple goals if you have an account that you want to link to multiple goals.

You can also track your goal contributions and expenses by linking your transactions directly to goals. You currently can only link transactions that happen in an account linked to the goal, but we're working on expanding this functionality.

We’re also launching debt goals today, which let you track your progress paying down your mortgages, student loans, credit card debt, and any other kinds of debt you may have.

What’s next for goals?

This is just the first step toward our vision of creating a robust financial planning system that can help you weigh the tradeoffs between all of your financial goals, and forecast a timeline for when you will achieve your goals. We’ll continue improving the goals experience over time to move us closer to our end vision. We’d love to hear your feedback on this first step!

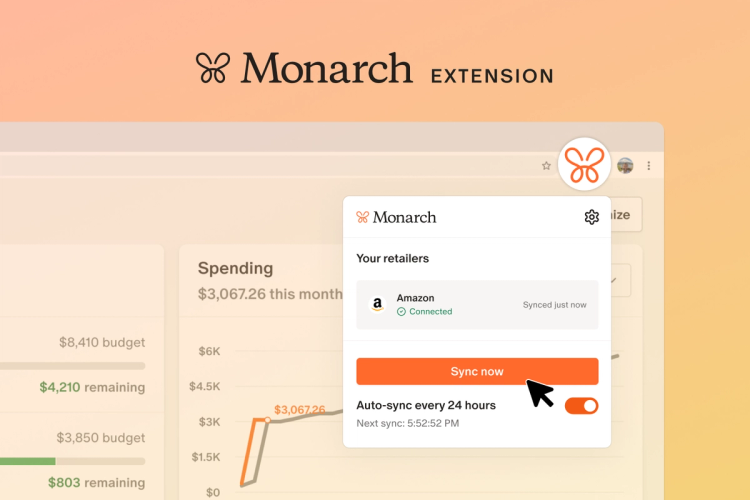

Account syncing

We've launched a number of tools to give you more control over your financial data in Monarch. Here are some of the highlights around account syncing improvements:

- We've launched a new institution settings page on web to help you manage your bank connections in Monarch. You can quickly see the status of all the connections between Monarch and your financial institutions, and there's a new button to refresh all your accounts at once.

- We also added the "refresh all" button to the Accounts page to make it easier to sync your latest financial data to Monarch.

- If you have new or missing accounts at a financial institution, you can click the menu item "Update login settings" to re-authenticate and pull in the latest account details from the institution.

- You now have the option to transfer the entire history of one account to another. This feature comes in handy when an account with significant history is no longer syncing, and you want to move its history to a new account that is synced with a different data provider. You'll no longer have to keep old accounts around to preserve their history, you can move the data between accounts seamlessly.

Merchant naming improvements

After thorough evaluation of all enrichment providers, we’ve switched to the top performer to ensure we can more accurately identify where you’re spending your money. As a result you will see fewer mistakes, but may also need to update some of your transaction rules so that they apply to the newer version of the merchant name.

Other improvements

- Added Apple Pay and Google Pay as payment options on the web.

- Removed the ability to edit transactions while they are pending. This decision was made because it is not always possible to link a pending transaction to its finalized version, which could result in loss of any changes made during the pending stage. We plan to introduce an advanced setting very soon that will allow users to edit pending transactions after acknowledging the associated risks.

- Added the ability to switch accounts between assets and liabilities if they come in incorrectly from the data provider.

- You can now download account balance history from the account details page.

Bug fixes

- Fixed the issue where the progress bar date indicator on budget categories on the plan page was missing. You can now see how you're pacing for the month again.

- Updating manual holdings will no longer delete history of that holding.

- Fixed an issue with adding real estate accounts in the mobile app.

What's coming next

- We're working on a monthly email report that will summarize all of the highlights that happened with your finances in the previous month. This email will go out to all members of your household, so if you have a partner with their own login in Monarch, they'll get it too. Keep an eye out for your first email report in April!

- We'll continue to make improvements and adjustments to the new goals feature as you get your hands on it and share your feedback.

If you have feature requests, or thoughts on anything above, please join our community on Reddit and start a conversation. We’d love to hear from you!