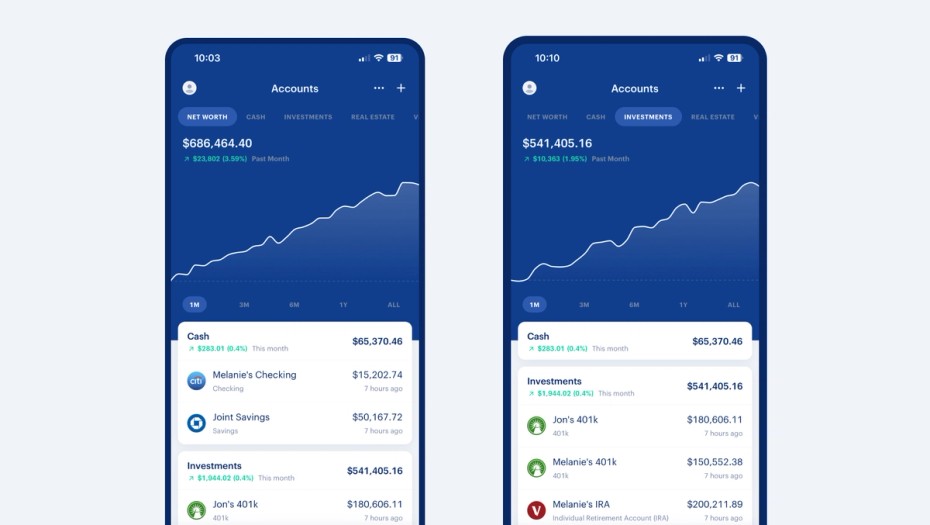

New Net Worth chart on mobile

This new Net Worth chart allows you to view your Net Worth over different periods of time, and interact with the chart directly to see the daily change. In addition, you can filter by Account type to focus on the change in your Cash, Investments, Loans, Credit Cards etc, and the sections on the page are now collapsible.

This is currently rolling out to customers in the iOS app, and will be available in the next version of the Android app.

Performance Improvements

January is always the highest volume month for personal finance apps like Monarch as people are motivated to get their finances in order for the new year. This natural seasonal spike along with the continued wave of users signing up from Mint meant we saw unprecedented volume in January, with daily sign-ups averaging 20X to 30X what we typically see.

As a result we had to increase capacity across all of our systems multiple times in January. Thankfully we only had a few minutes of unplanned downtime, but there were periods of degraded performance. We apologize if you experienced slow app performance at any point. 😞 The good news is that our performance has stabilized at the new levels. Additionally, we have made dramatic performance improvements in the Android app.

Investment transactions in Beta

You can now opt into syncing transactions from your Investment accounts. This feature is still in Beta, but you can enable it in your Monarch account by going to Settings > Preferences.

When this setting is turned on, Monarch will automatically start syncing transactions in your Investment accounts. The transactions will be displayed in the main Transactions page list, and on the Account detail page for each account. The transactions will be included in your budget and cash flow the same as other transactions.

A caveat: this feature is still in Beta because we are seeing a wide range in investment data quality and accuracy, depending on the underlying financial institution. We are monitoring each institution and working with our data partners to address where needed (see next item).

Connection Improvements

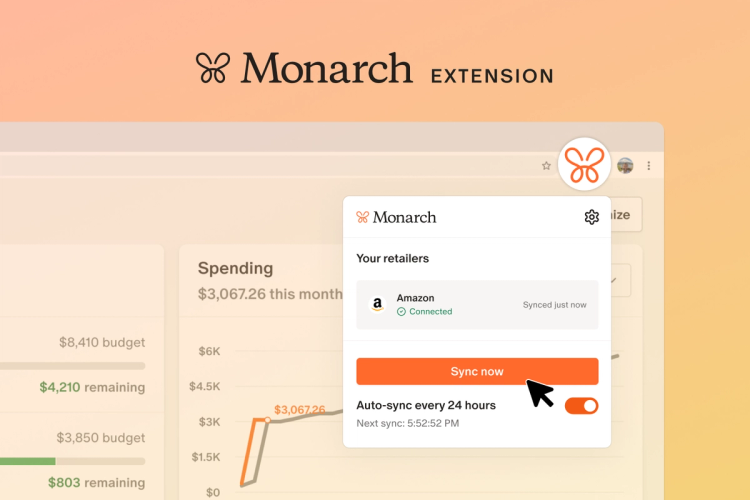

The vast majority of data connections in Monarch are "healthy", which we define as being connected, staying connected, and updating at least every 24 hours.

Unfortunately, that's little consolation if you have a connection that falls into the minority. We recognize it's extremely frustrating if your particular institution doesn't stay connected or the data is delayed.

We are always monitoring every connection and then working with our data partners to improve the problem institutions. Unfortunately, this is an inherently slow and frustrating process where we must work with our data partners, who in turn must work with the underlying financial institutions to try and address the issue. And let's face it – financial institutions are not known for moving quickly. This is the reason why connection related issues are often slow to resolve, and we cannot provide a timeframe on when they might be resolved. Trust us, we wish we could.

We work with multiple data partners and more than 15,000 institutions, which means there's an endless amount of edge cases to work through. The good news is we have a lot more data to see patterns on what's working and what's not with each data partner and institution, and a lot more leverage with them due to our increased size.

We will continue to work through these issues. In the meantime, we are making other improvements, such as adding additional data partners (aggregators), as well as exploring ways to provide more customer facing visibility into institution connectivity and reliability.

Updates to Reports

We've made multiple enhancements to our new reporting feature:

- Improved the handling of refunds and other large positive transactions in expense categories

- Added a new filter for "Account Types", such as Credit Cards, Cash, Investments, Loans, etc

- Added the ability to easily share and download charts. You can hide the dollar amounts on any chart to keep the amounts private while still sharing the trends.

More enhancements coming soon based on your feedback. Please keep it coming!

New budget settings

We've added new budget settings that make it easier to get started and also change budget values over time. This includes:

- The ability to recalculate default budgets. This is especially useful if you’ve added additional accounts or transaction history since originally setting up your budget.

- The ability to clear all budget values. This lets you start from scratch with your budget.

CSV Import Improvements

- Added the ability to upload transaction history into Investment accounts and move transaction history into Investment accounts. This is the same functionality that was already available on non-Investment accounts.

- Fixed an issue with CSV imports where empty rows caused the upload to fail

- Fixed an issues with CSV imports where duplicate account balance rows caused the upload to fail

Other Improvements & Bug Fixes

- Newly added loans that come in from data partners with an inverted balance are now automatically fixed. Inverted balances make it look like your loan is adding to your net worth instead of subtracting from it. You can still use the Account Setting to manually invert balances if needed.

- New account setting to choose between current balance and available balance. The default for all accounts is current balance.

- The iOS budget widget now supports Group budgets.

- Fixed an issue where Robinhood Brokerage account balances stopped including Cash holdings. Note, if you are still seeing an incorrect balance, go to the Account settings and switch the account to use the available balance instead of the current balance.

- Fixed an issue where the Investments page was not using the same price data in all places. Some spots were using a “real time” price and some were not.

- Fixed an issue where it was not possible to delete multiple transactions at once in the mobile app

- Fixed an issue where archived goals were still assigned to accounts.

- Fixed an issue where the Budget Rollover icon was missing in the mobile app, and also incorrectly showing on the Budget page for Goals.

Customer Support Wait Times

As mentioned in our previous update, our customer support team has been crushed with the sudden and unpredicted volume of tickets from the influx of Mint users and our response time has degraded from 24 hours to multiple weeks in some cases. We're really sorry if you've contacted us and we haven't responded in a timely manner. This is unacceptable.

Here's what we're doing to address it:

- We have increased our staff size from 3 people to 22. The new CS reps have recently completed training and are responding to tickets. We are (finally) answering tickets faster than they are coming in and we expect to answer most tickets within 2 business days after this week.

- We've added the option to chat with an AI agent ("Mariposa") if you want an immediate response. This works well for basic requests, but is less helpful for more complex questions. We are continuing to train the AI and it's getting better over time. You can always contact our Support team directly without chatting with the bot.

- As mentioned above, we will be launching new tools to help people better understand and troubleshoot connection issues with specific institutions.

What's coming next

Here's what currently in progress:

- A completely overhauled goals system

- The ability to track bill due dates

- The fixed / flex budgeting system

We're Hiring!

We'll be hiring for a number of new roles across engineering, product, design, and marketing so that we can move even faster and better serve you. These roles will be posted in the coming weeks. We love hiring Monarch customers, so if this sounds interesting keep an eye on our careers page for the new roles.

Check out our Public Roadmap to see more details about what we’re working on currently, and what we’re considering building next.