What a week!

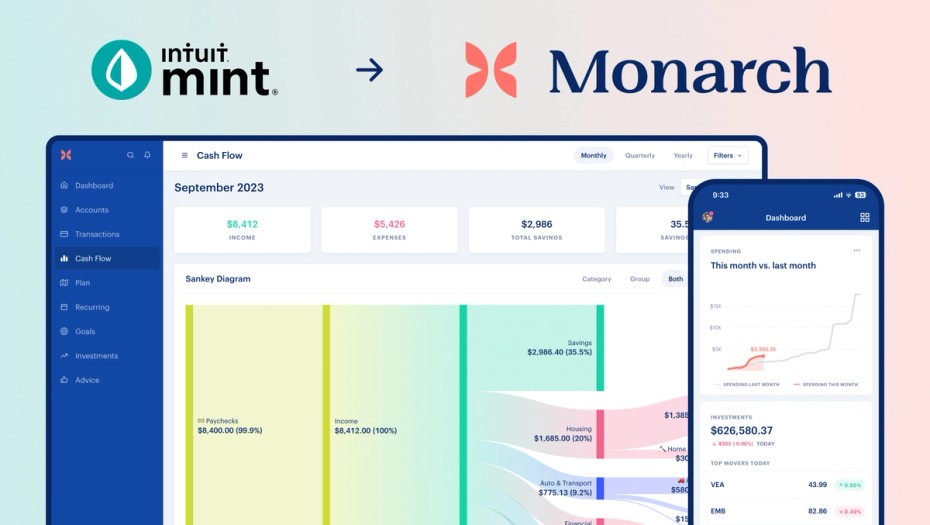

Like many of you, we were shocked to hear that Intuit will be shutting down Mint and asking users to migrate to Credit Karma, which will only support a subset of Mint’s functionality and three years of users' financial history.

We’ve seen a massive influx of new users on Monarch this past week. First, I want to thank everyone who has tried Monarch this past week and also shared your feedback. We know this is a big decision and an important part of your financial journey. We view ourselves as your partner on this journey and it’s a responsibility that we take very seriously.

To that end, I want to share some of the improvements we’re making based on your feedback.

Improved Mint data importer

At the time of the Mint announcement, Monarch was one of the only personal finance apps that provided the ability to import your Mint data. Unfortunately, it was never architected to handle the types of load it’s seen the past week. Suddenly we had folks importing tens of millions of transactions per day, and there were some performance problems and unexpected errors. We really apologize if you’re one of the people that ran into issues with your import.

We have been working around the clock to rearchitect our Mint importer and it’s very reliable now. What’s more, we’ve made some improvements to the functionality, including:

- Added the ability to map your Mint categories to Monarch categories. This gives you complete control over how your Mint categories will show up in Monarch!

- Added the ability to map your Mint tags to Monarch tags

- Added a preference that lets you choose between prioritizing Mint transactions, or previously synced Monarch transactions.

- Added a filter to the transactions page in our web app that lets you filter to imported transactions or synced transactions, to help with bulk editing/deleting all those new transactions.

If you tried your import previously and ran into issues, please try it again!

Data connectivity

On a similar note, we’ve had some performance issues with syncing financial institutions due to the load. Accounts have been slower to sync than normal, so if you connected your account and didn’t see your data quickly, please try again. We’ve added a lot more capacity here.

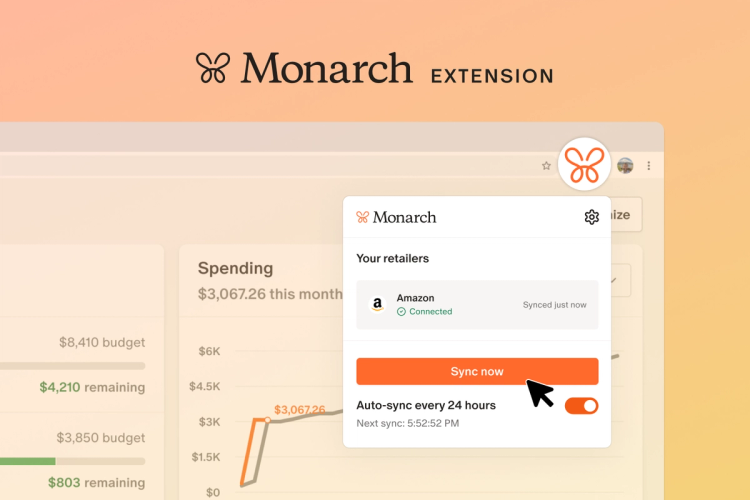

It should be noted that Monarch syncs data differently than Mint. When we built Mint, we designed it to sync data whenever you opened the app. This reduced our data costs, but also created a laggy experience for users whenever they opened the app. Monarch syncs your data in the cloud every 24 hours. Even though this is more expensive for us, it provides a better user experience as your data is up-to-date as soon as you open the app and you don’t have to wait on a sync. You can also manually force a sync inside the app if desired.

Change is hard

As the first product manager on the original Mint team, I recognize that some of you have been using this app to manage your finances for up to 15 years (!) and that the idea of losing the history and functionality you’ve come to rely on is super frustrating. Nobody wants to have to learn a new app (let alone migrate their data), and the natural tendency is to try to find something that most closely matches your experience using Mint.

Our goal with Monarch was never to re-create Mint feature by feature. Our goal has always been to build the best possible platform for managing your household finances. (You can read more on where we’re headed below.)

That said, the past week has shown us that there are some very important features to Mint users that are missing in Monarch. To that end, we will be adding the following features shortly:

- The ability to view your credit card statement due dates, statement balance, and payment due dates

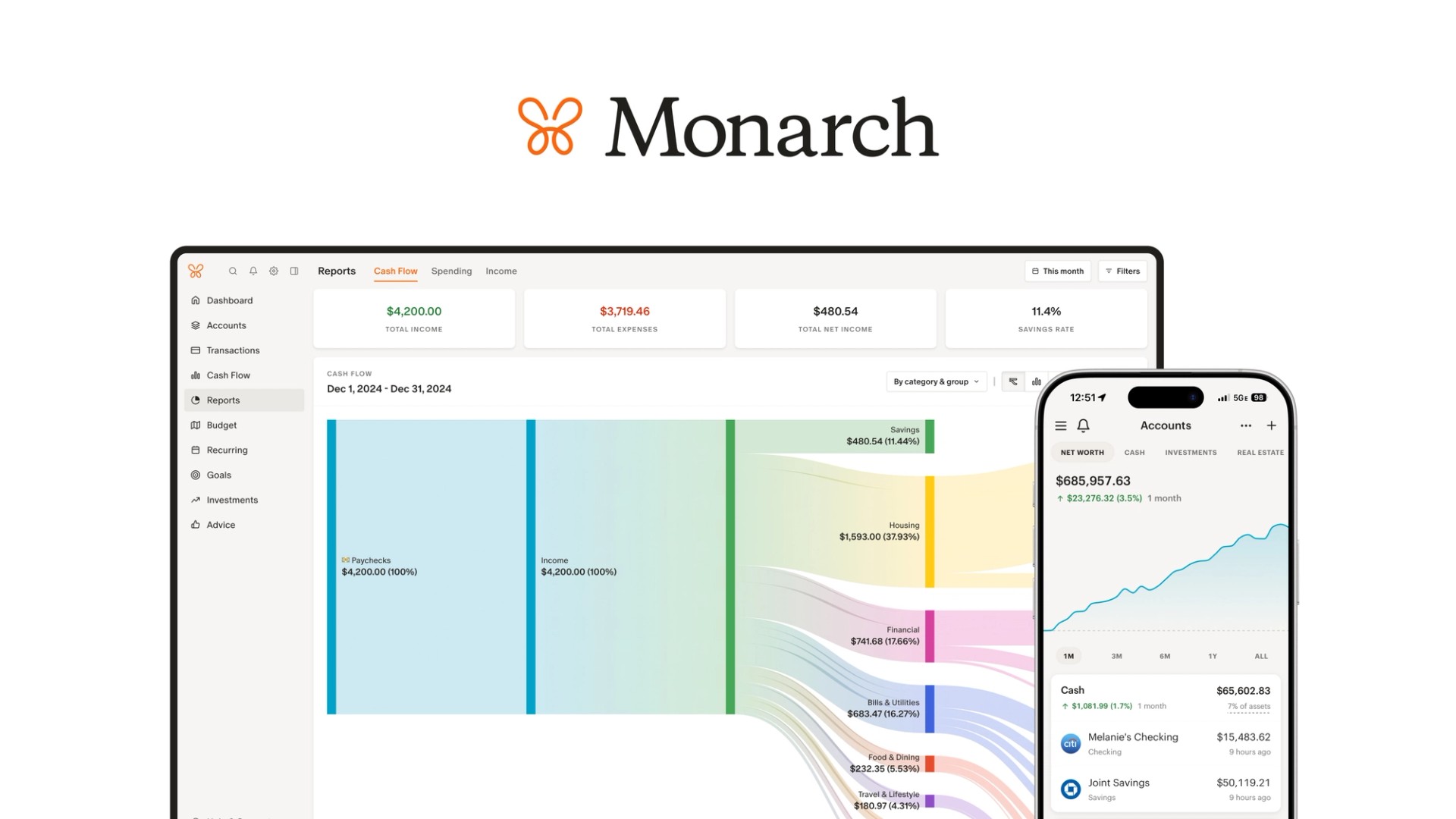

- The ability to generate more granular graphs and reports

- Support for Canadian customers (Join our waitlist!)

We’re still sorting out the implementation details on some of these so don’t have estimated timelines yet, but we’ll update folks when we have more clarity on timing.

Finally, I would encourage you to keep an open mind during this transition. There is a learning curve with a new app, but once people are up-to-speed with Monarch we almost always hear some version of “So glad I switched! This is so much better than what I was using before!”

Where are we headed?

Our mission with Monarch is to help people improve their financial health and lead a richer life.

What does that mean in practice? We talk to our customers every week. What we hear is that while they do want help tracking and budgeting their money, they also need help planning their future, tracking progress against goals, minimizing their taxes, optimizing their investments, and establishing the right estate plans and insurance coverage.

In other words, they need help with their entire financial journey.

Budgeting and tracking are necessary, but it’s just scratching the surface of what’s required to actually help people improve their financial lives. Frankly, our industry has been stuck at the “budgeting/tracking” phase for far too long. There has been very little innovation in this space since we launched Mint 15 years ago. We started Monarch to fix that.

We still have a tremendous amount of work to do. But we’re listening to our customers and we’re building rapidly. Hopefully, our responsiveness in the past week demonstrates our commitment to helping you on your financial journey.

After we roll out these additions mentioned above, we will be launching our next version of goals and planning soon. We will also be launching a new budgeting philosophy and functionality that we believe is more powerful (and easier to follow) than anything to date.

As you consider what to do around the Mint transition, we hope you join us on Monarch as we build the future of personal finance. We’re passionate and committed about helping you along your financial journey.