In a financial landscape where emergency expenses have risen sharply, families are increasingly feeling the strain of non-monthly expenses. Whether it's the irregularity of property taxes, the unpredictability of emergency repairs, or the sudden need for pet expenses, these costs can derail the most thoughtful of budgets.

From individuals struggling to get a grip on their finances to budget-conscious families planning for future expenses, this article offers a practical guide on anticipating, preparing, and saving for these financial demands.

We understand the challenge of managing a tight budget while trying to avoid unexpected costs, and we'll discuss practical ways to navigate these waters.

Understanding Non-Monthly Expenses

Non-monthly expenses are those costs that don't occur regularly, such as quarterly insurance payments, annual property taxes, or unpredictable emergency expenses.

Recent data shows a significant increase in emergency expenses, from an average of $1,400 to around $1,700 since July 2022. These costs can be budget busters if not planned for, often resulting in using credit cards or dipping into savings for other financial goals.

A recent Bankrate report reveals that nearly one in three people have some emergency savings, but not enough to cover three months of expenses—an increase from 27% in 2022. More alarmingly, nearly one in four U.S. adults have no emergency savings. These figures underscore the importance of having a safety net to cover unexpected expenses that may arise.

Assessing Your Financial Readiness

To begin, it's essential to understand where you stand financially. How much do you currently have in savings, and how does that compare to the potential cost of an emergency?

With 57% of Americans unable to afford a $1,000 emergency expense, it's clear that many are not prepared for the unexpected. Evaluating your savings in the context of these statistics is the first step in understanding the urgency of planning for non-monthly expenses.

How to Prepare for Non-Monthly Expenses

Now that you know the urgency and challenges and their potential to destabilize budgets, let's explore practical steps to include non-monthly expenses in your financial plan without disruption effectively.

1. Create a Separate Savings Account

One of the most effective strategies for managing non-monthly expenses is creating a separate savings account for these costs. This account should be distinct from your emergency fund and regular savings.

Creating a savings account specifically for unexpected or non-monthly costs not only aids in allocating funds for annual expenses but also guards against misusing these funds for daily spending. This targeted savings approach provides a clear view of your savings milestones and adds flexibility in managing your finances.

While managing multiple accounts might require more attention, some banks offer helpful features to oversee various savings goals within one account for simplicity.

2. Estimate and Track Non-Monthly Expenses

To effectively save money, you need to know how much you're aiming for. Start by making a list of all your non-monthly expenses, including everything from car maintenance to membership fees. Then, estimate how much each expense will cost and when it will occur. The table below illustrates how to estimate and track non-monthly expenses.

Expense Category | Estimated Cost | Due Date |

Property Taxes | $XXX | MM/DD/YYYY |

Car Maintenance | $XXX | MM/DD/YYYY |

Pet Expenses | $XXX | MM/DD/YYYY |

*Please note that the table is for explanatory purposes and could be modified to suit your needs.

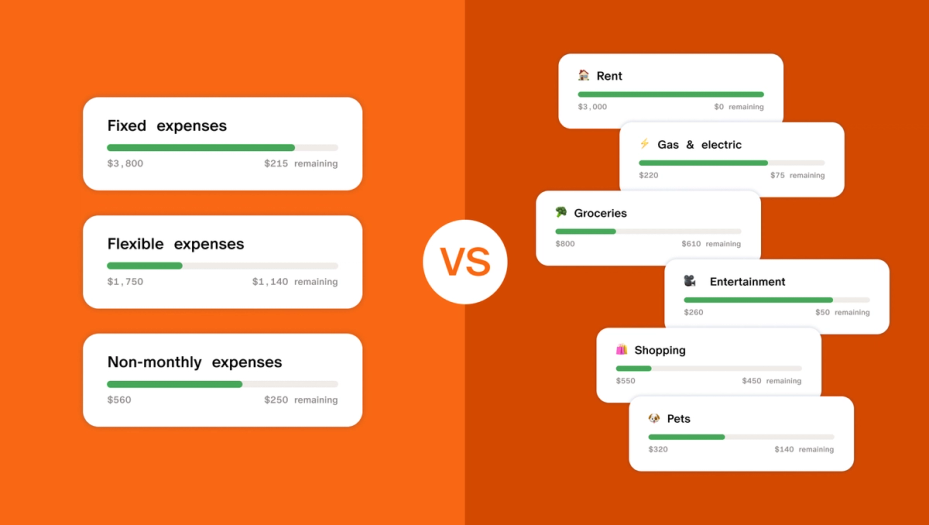

3. Create a Budget for Irregular Expenses

Budgeting is the next step after evaluating non-monthly costs and adding them up to understand their yearly impact. Review your bank and credit card statements from last year to catch any non-monthly expenses you might have missed. Once you have the total, you can break it down into twelve monthly installments as if they were a regular bill.

Anticipate the upcoming year's events or travel plans so you can set aside funds and save money efficiently. Embracing technology can significantly streamline the budgeting process for irregular expenses. Use smartphones and budgeting apps to keep a close eye on your expenditures and receive timely reminders for impending payments.

Acknowledge that some bills, such as utilities, won't be the same each month, and ensure you budget a bit more to handle these variable expenses. By preparing for these expenses monthly, you're organizing your finances and also saving money.

4. Build an Emergency Fund

Establishing and growing an emergency fund should be a priority. Before you can focus on saving for non-monthly expenses, you need the security of knowing you can handle a financial shock without derailing your budget. Start small, if necessary, and build up to an amount that makes you feel secure, aiming for three to six months' worth of living expenses.

Sinking Funds: Making Non-Monthly Expenses Part of a Monthly Budget

As mentioned earlier, the secret to handling non-monthly expenses effectively is approaching them as if they were monthly bills. This approach involves setting aside a small amount each month to have the funds ready to go when the bill comes due. This method, known as "sinking funds," helps to smooth out your cash flow and takes the stress out of irregular expenses.

Cost Cutting: Identifying Areas to Reduce Spending

Cutting costs is vital to free up money for non-monthly expenses. By reviewing your own budget line by line, you can identify areas where you may be able to spend less. This could mean cutting back on dining out, renegotiating bills, or eliminating unused subscriptions. Every dollar you save can be redirected into your savings for non-monthly expenses.

Take a close look at your fixed expenses and ask yourself where you can realistically cut back. Also, variable costs like groceries, gas, and entertainment often offer the most flexibility. Can you use coupons or switch to generic brands to save on groceries? Could you carpool or use public transportation to lower your gas expenses?

Cost-Cutting Strategies

- Comparison shopping: Before making a purchase, compare prices across different retailers to ensure you're getting the best deal.

- Bulk buying: Purchase non-perishable items in bulk for lower per-unit prices.

- Energy efficiency: Implement energy-saving measures at home to reduce utility bills.

Planning Ahead for Big-Ticket Items

Planning ahead is crucial for larger purchases, such as a new car or appliance. Start by determining the total cost of the item and then divide that amount by the number of months until you plan to make the purchase. This gives you a monthly saving target to add to your budget.

Plan your savings goal by setting a purchase date and considering cheaper options if necessary.

- Set a target date: Decide when you want to purchase and work backward to determine your monthly savings goal.

- Consider alternatives: If the cost seems too high, consider whether a less expensive alternative would meet your needs.

Preparing for Annual and Seasonal Expenses

Anticipating and saving for annual and seasonal expenses such as holiday gifts or property taxes is key to avoiding financial strain. To prepare for these predictable costs, you can use calendar alerts on your mobile devices to remind you of upcoming expenses several months ahead, giving you ample time to save.

Additionally, if you find that an anticipated expense will be higher than initially thought, it's essential to adapt by increasing your monthly savings goal to ensure you can cover the extra amount when it's due.

Conclusion

Managing non-monthly expenses requires foresight, discipline, and a proactive approach to budgeting. By creating a separate savings account, estimating and tracking irregular expenses, and making them a regular part of your monthly budget, you can prepare for these costs without stress. Remember that even small amounts saved regularly can accumulate over time, providing a financial cushion when needed.

As you continue on your financial journey, Monarch is here to support you every step of the way. With our guidance and your commitment, you can achieve the financial stability and peace of mind you deserve.

Please take the first step today by reviewing your spending and setting up a dedicated savings account for non-monthly expenses. Remember, the best time to start planning for the future is now.

Additional Resources

For more information on budgeting and financial planning, explore our selection of tools and resources designed to help you manage your money more effectively. With the right strategies in place, you can navigate the challenges of non-monthly expenses and secure your family's financial future.