When inflation is on the rise, your money doesn’t go as far as it used to. Put simply, inflation is an increase in prices over time that lowers your purchasing power and impacts the value of your savings. Since wages don’t typically keep pace with inflation, rising prices can put a real strain on your finances.

The good news is that you can ease the financial pain of inflation by making a few key adjustments to your budget. The first step is to get back to budgeting in the first place, if you’ve lost the habit. Then, pay off variable and high-interest debt, examine your spending, and dial up your savings.

Let’s look at some budget adjustments you can make to help your money go further during inflation.

What Is Inflation?

Inflation is the rise in prices of consumer goods and services over time. Gradual inflation is a sign of a growing economy. However, high levels of inflation, like the ones we’ve seen in the past two years, can shrink your purchasing power. The Federal Reserve uses interest rate increases to fight inflation.

By making borrowing more expensive, the Fed tries to slow down price increases. If you’re wondering what to do when inflation is high, budgeting is a powerful tool. When you can manage your income and expenses, you’re on the right track to surviving inflation.

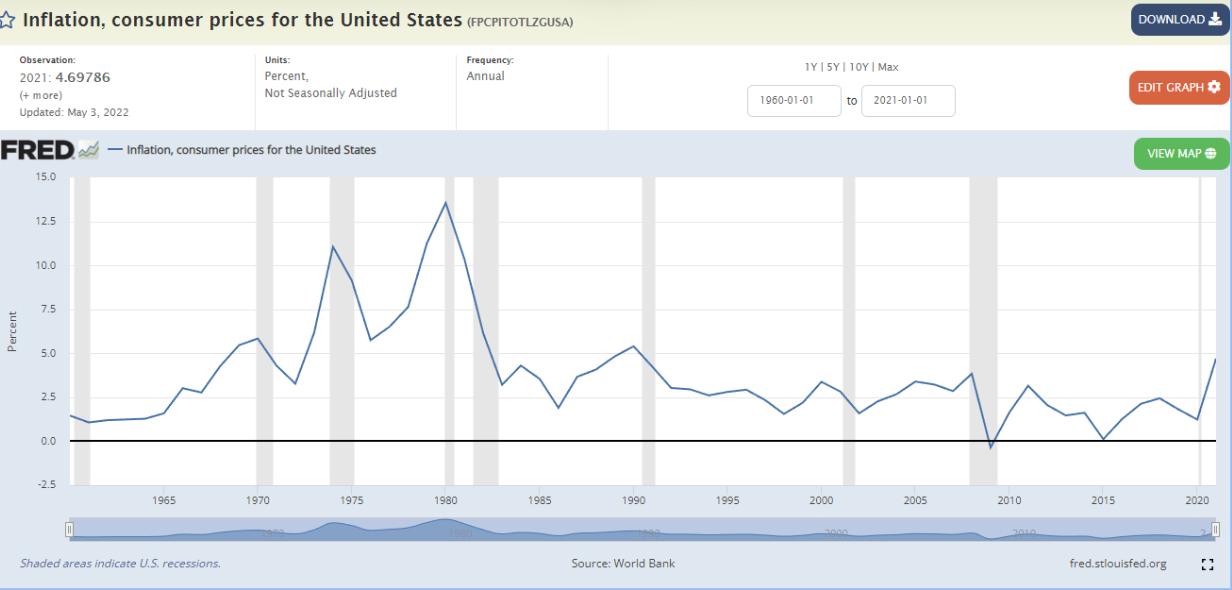

You can use this handy inflation tracker from the Federal Reserve Bank of St. Louis to see inflation over time, and where we stand today.

1. Start a Budget

If you don’t already have a budget, now is the perfect time to start. If you’re just learning how to deal with inflation, a budget can show you where you stand and help you use your money in a better way. The right budgeting strategy will grow your freedom by helping you meet financial goals.

Having a budget might also help you identify the ways inflation is specifically affecting you. You’ll be more likely to notice an increase in spending in a specific category (groceries, for example) if you have a budget and an idea of how much you should spend regularly in that category.

How to Budget for Inflation

There are three types of expenses you should consider when building your inflation budget:

Fixed expenses: These are typically paid monthly. They’re items like your mortgage/rent, utilities, insurance premiums, subscriptions and daycare.

Flex expenses: These are daily expenses that can fluctuate, like groceries, entertainment, auto fuel, house supplies, and clothing.

Non-monthly expenses: These expenses are less frequent than monthly and are often large. Think family vacations, car repairs, home maintenance, holidays, and birthdays.

Budgeting Example

As an example, let’s say your family’s monthly take home pay is $7,000. Let’s budget this out, starting with fixed expenses. $2,000 goes to your mortgage. Another $1,500 goes to daycare. You pay $500 for a car payment and car insurance, $300 for utilities, and $100 for a phone bill.

After these fixed expenses, you have $2,600 left. Next, take your flex expenses and non-monthly expenses and estimate them, starting with the big expenses like groceries and transportation.

Pro Tip: The Monarch Money app can help you create a budget easily by syncing multiple accounts for different family members and delivering a birds-eye view of your finances.

2. Pay Off Your Variable Debt

As your expenses increase from inflation, it’s vitally important to pay off debt with variable interest rates. When inflation goes up, The Federal Reserve often acts to raise interest rates to try to slow down price increases. Unfortunately for those with variable debt, this also means your interest rates will rise.

The main way rising interest rates will affect you is through your credit cards, but you might also have an adjustable-rate mortgage or a variable-rate personal or home equity loan. If you’re not sure, check with your lender to find out.

Pay Off High Interest Debt First

If you have significant debt at a higher variable rate (anything above 7%), prioritize paying this off first by tightening your budget. If you can't do that, you might consider other options. Some people consolidate their debt at lower rates with personal or home equity loans. If you’re considering this approach, consult with a financial advisor to make sure it fits with your unique situation.

How It Helps

Here’s how high interest debt can hurt you — and how it helps to pay it off. Let’s say you have a credit card with a $1,000 balance at 20% interest. If you can only budget $50 a month toward debt payments, it could take you more than two years to pay it off. That’s because the interest compounds every month. When you first start paying it, a large portion of your payment goes toward the interest — not paying down the debt.

3. Review Your Budget Regularly

It’s smart to revisit your budget as your priorities change and the economy changes. What works for you one month may not work the next. Inflation makes it impossible to “set and forget” your budget.

For instance, if you have an adjustable rate mortgage, and your payment climbs by $200 a month, you may need to tighten your budget elsewhere. Set a calendar reminder to revisit budget items that are subject to inflation quarterly, so you can update your strategy.

This takes time and diligence, but it can pay off by removing unpleasant surprises from your finances.

4. Save on Regular Expenses

When inflation runs high, get creative by saving on regular expenses. Here are some methods to reduce your regular costs:

Utilities: Lowering your utility usage can be as simple as unplugging unused appliances and turning off lights. You might also install a programmable thermostat to raise or lower the temperature when you’re not home. Also, old appliances are a huge contributor to high utility bills. If you have the means, it might be a good time to upgrade that refrigerator or AC unit. An energy-efficient $800 refrigerator can save you $260 over its working lifetime.

Insurance: Shop around for more affordable home, auto, and life insurance. Keep in mind that many providers offer discounts for bundling insurance. “Paying annually rather than monthly could also be an option,” says Natalie Taylor, CFP, BFA. Or if you have permanent life insurance, consider whether switching to term might meet your needs at a lower cost. Just make sure you put your new coverage in place before you cancel your existing coverage.”

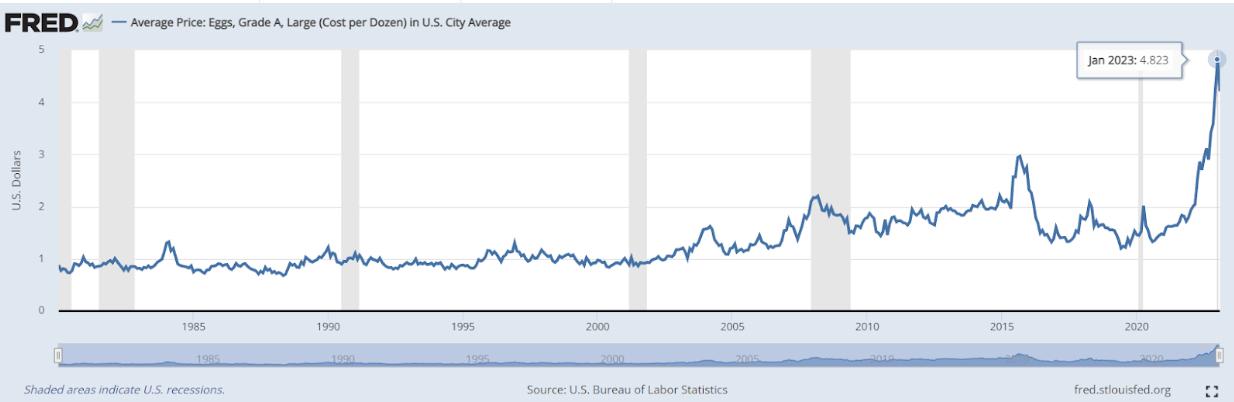

Groceries: Save on groceries by taking advantage of sales and stores with lower prices. Get a membership at a wholesale club and buy your groceries in bulk. During times of high inflation, some prices can increase while others don't. (For example, the price of eggs in the U.S. rose stratospherically in early 2023, even relative to other things). Watch prices more closely during inflation and modify your shopping to avoid foods with sharply rising prices.

Transportation: You can cut costs on transportation in a variety of ways. Start by grouping errands together, using alternative means of transportation when available, and consider consolidating to only one vehicle. Using more public transportation (if its available where you live) can help. Often those prices are set by law and won't climb as much as other transportation prices do.

5. Cut Unneeded Expenses

Budgeting can help you weather the rising prices of inflation by giving you control over unnecessary expenses. But if inflation is affecting your retirement savings or your ability to buy groceries, it may be time to cut back on the non-essentials. You can:

Reduce your budget for nonessential shopping.

Assess your subscription services. Review your credit card statements for regular payments you don't actually need. (You can always re-start later.)

Substitute less expensive options for items like luxury clothing, electronics, or food items.

But be mindful as you eliminate expenses. Don’t cut out expenses that bring you joy that far outweighs the cost — like a $12 a month streaming service you use for weekly family nights.

6. Grow Your Earnings

Budgeting often emphasizes cutting costs, but you can also grow your earnings. Here are four methods to help you know what do in inflation to grow your earnings:

Ask for a raise: If your employer is doing well and it’s been at least a year since your last raise, consider asking for another. Research the typical pay increase based on your sector and be prepared to negotiate by showing your achievements and explaining how you’ll help the company over the next few years.

Request a cost of living adjustment: Inflation was about 6.4% at the end of 2022. If you were making $100k a year and your employer does a cost of living adjustment to match inflation, your new salary would be $106,400.

Pursue a more lucrative job: Pursuing a higher-paying job can be one approach when you’re wondering how to deal with inflation. Research salaries for roles similar to yours or look into a position you could grow into at your current company.

Start a side hustle: Many people have side hustles to generate extra income. You might try consulting, freelancing, or building a passion project into a business.

7. Save Your Money

You may have already made space in your budget for different savings goals, like your emergency fund, a down payment fund, and/or a vacation fund. Since cash loses value during inflation, consider moving your savings to high-yield savings accounts (HYSA) that pays 3.5% - 4%+.

For example, if your emergency fund has $20,000 in it, and you’re receiving 4% interest, you’ll earn $800 a year just in interest, giving you $20,800. After another year, you’ll earn $832 in interest, growing your fund to $21,632. After 10 years, you’ll have made over $9,600 in interest.

This idea for how to save money during inflation is fast, simple, and generally effective, since it helps your savings keep pace with rising prices.

8. Invest Your Money

Rising interest rates might give you higher returns on your investments. Look into Series I Bonds that are currently paying 6.89% interest. Other conservative investments, like CDs, can be good places to park funds while you decide where to invest long-term. They’re low-risk and can provide you with a higher return than a HYSA.

For example, if you have $5,000 in Series I Bonds at 6.89% interest, that bond will earn $344.50 in interest the first year. These bonds can earn interest for up to 30 years, or until you cash them in. The interest compounds annually, so if you hold the bond for 10 years, your initial investment of $5,000 will grow to $9,735 if the interest rate stays elevated.

This method for how to survive inflation gives you another safe haven from the shrinking effect rising prices can have on your savings.

9. Watch for Falling Prices on Big-Ticket Items

Part of knowing how to manage inflation is to watch for falling prices. Remember that the Federal Reserve curbs inflation by raising interest rates. This cools off the market. If you’ve been looking to buy a house or a car, it’s smart to watch for dips in prices, especially in certain markets.

You can keep an eye on some of these prices by tracking average car costs over time here, and the average monthly prime lending rate here.

Since interest rates are high now, they’re also limiting your buying power. They fluctuate, so pay attention to the dip and see if you can lock in a better rate.

Why Does Inflation Happen?

Inflation can happen for a variety of reasons, but it largely comes down to simple supply and demand. If there’s a decrease in supply, a rise in demand, or both, prices tend to rise. When this happens to many different types of goods and services across different industries, we call it inflation.

Let’s take how inflation has occurred in recent years as an example. The COVID-19 pandemic caused many businesses to fail. This caused shortages in manufacturing supplies and food production. Shifts in demand from more people staying at home caused rising prices in many categories. Russia’s war in the Ukraine added international issues, as countries faced shortages from trade embargos.

People Spend Less

We saw a period (during COVID-19 lockdowns) when consumers didn't spend much money at all. Then all of a sudden they were spending a lot. The sudden jolt from "business as usual" to "can't keep anything on the shelves" to "slower than usual business" has exacerbated supply chain imbalances originally thrown out of order by the lockdowns themselves. All of this creates a series of market inefficiencies that show up as increasing prices.

People Earn More

Inflation leads to moderate wage increases, so even when supply chain factors and other economic conditions subside, the cost to produce the goods we buy has irreversibly increased.

FAQ

Here are answers to some of the most frequently asked questions about what inflation means to your finances.

How do you survive financially during inflation?

Budgeting is a big part of how to survive inflation. By monitoring your spending, anticipating expenses, and finding ways to generate income, you’re more equipped to know how to deal with inflation.

Where do you put money during inflation?

You should continue to save and invest during inflation. Save your money in a high-yield savings account and park your investments in CDs, Series I Bonds and money market funds. These will all earn interest and are low-risk ways to invest during inflation. Especially when inflation is high, check to see if your interest rates are actually outpacing rising prices. Otherwise your investments are losing money.

What type of budget should you use during inflation?

Use a budgeting strategy that accounts for fixed monthly expenses, flex expenses, and annual expenses. Expect that some of these (such as a mortgage and a fixed car loan) will stay the same, but your flex expenses, such as groceries and fuel costs, will vary.

What should you not do during inflation?

Don’t go into unnecessary credit card debt during inflation. While you should always avoid this, when inflation is high, the Fed responds by raising interest rates. That means debt with variable rates — like credit cards — will cost you more if you don’t pay it off quickly.

Summary

Knowing how to deal with inflation can put you on a firm financial footing when prices go down. While inflation brings plenty of difficulty, it does have some upsides. Assets like a home or your car may increase in value. Investments in commodities like oil or food may see increased profits. Interest rates on HYSAs and bonds typically go up, creating greater returns on the money you invest in them.

By budgeting and planning, you can learn how to survive inflation while prioritizing your financial goals. This may mean planning longer for a big vacation or buckling down to pay down debt and prioritize investing. You can protect yourself from inflation by organizing finances and tracking the health of savings and investments with intuitive financial software.