Retirement

Calculator

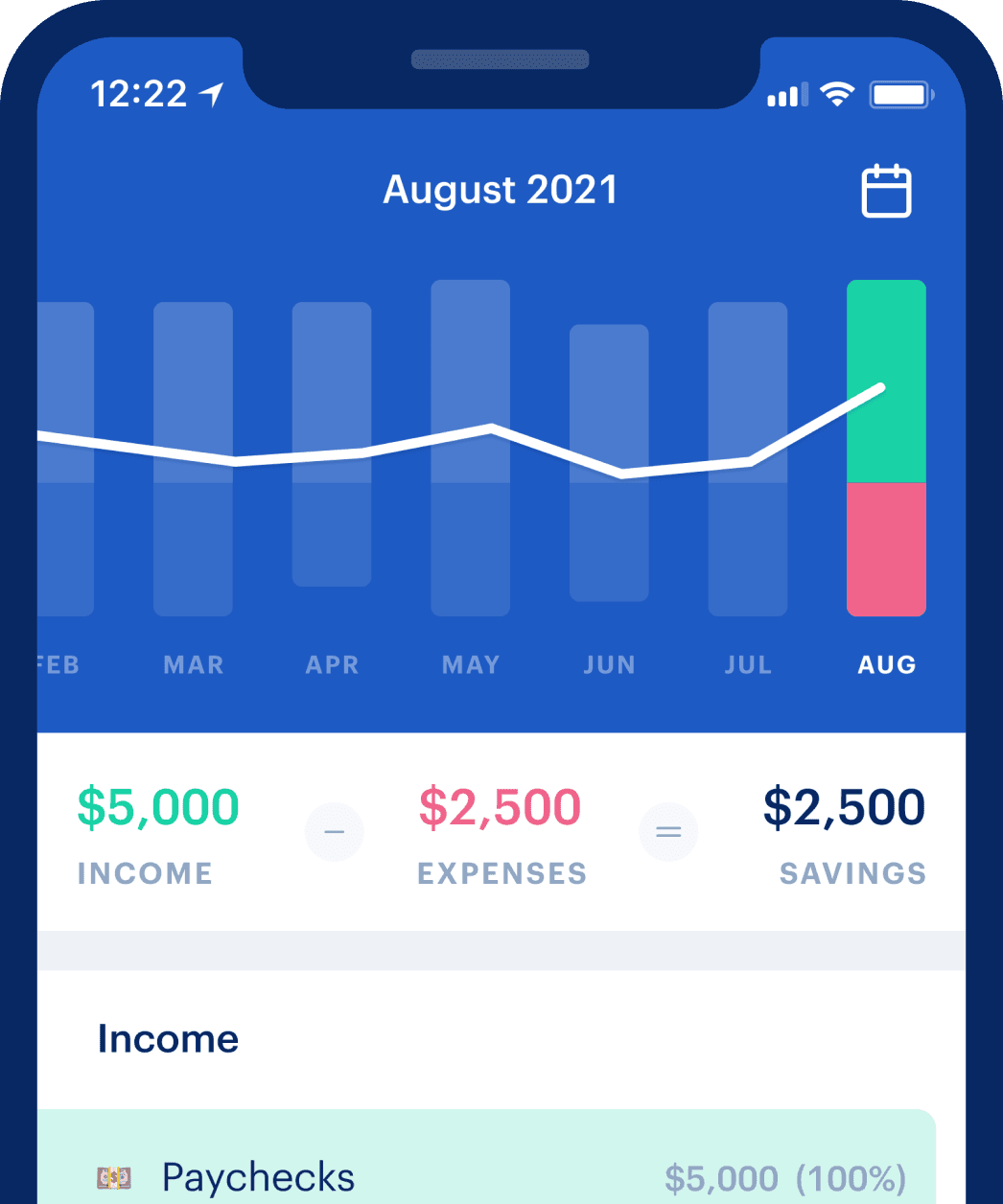

Gain total control of your money

Track all of your accounts in one place, collaborate with your partner, and create a long term plan to achieve your goals. Get personalized advice along the way.

How the calculator works

This calculator was made to help you understand how your savings rate, income growth, retirement spending, and other variables strongly impact how long it will take you to save up for retirement.

Enter your information, and see how the calculation changes. As you change the values, the results will automatically update. Here's a brief description of all the variables at play:

- Current age. This one is simple, enter your age! It doesn't matter if you enter your age or your partner's age, the calculator will tell you the number of years until retirement relative to the age you enter.

- Post-tax income. Enter the amount of money your household takes home after taxes, plus any pre-tax savings you are putting aside for 401k contributions, or FSA / HSA accounts. If your employer matches contributions, include that in this amount for more accurate results.

- Annual expenses. All of your household's living costs in a year. For most households this can fluctuate, so enter a number that is a little higher than your current expenses if you think there's a chance you'll spend more in the future.

- Income growth. This is the percent of income growth you expect each year. If there are multiple income sources in your household, enter a conservative average. If your income growth is less than inflation, eventually your spending will outpace your income, which is why it is so important to pursue raises.

- Inflation rate. Inflation lowers the purchasing power of every dollar you have each year, so it's important to factor in to the calculations. You may think you can survive on $60,000 per year when you retire in 20 years, but that $60,000 will have the purchasing power of about ~$32,600 in today's dollars (if the average inflation is 3% per year). So the further out you're forecasting, the more money you'll need to overcome inflation.

- Current investments. This is the amount of cash and investments you have set aside for retirement already. We'll forecast how this will grow with your additional annual savings and investment returns.

- Stock allocation. The percent of your portfolio made up of stocks.

- Bond allocation. The percent of your portfolio made up of bonds or other fixed rate assets.

- Cash allocation. The percent of your portfolio made up of cash.

- Retirement expenses. The amount of money in today's dollars your household will spend each year in retirement. We adjust this number for inflation for each year the calculation extends.

- Target withdrawal. The percentage of your retirement portfolio you plan to liquidate and spend each year in retirement. Generally, 4% is considered a safe target withdrawal percentage. 2-3% is considered very safe.

- Average tax rate. Your expected average tax rate during retirement. Taxes will increase the amount you need to withdraw to cover your retirement expenses. This is a complicated number to calculate exactly, so we recommend using something more conservative for the calculation. This should be a blended estimate of your federal and state taxes, and how taxes are applied to your various retirement accounts.

- Stock returns. Enter your average expected rate of return on the stocks in your portfolio. The average stock market return for the last 150 years was 8.1%, but that does not mean that will hold true into the future. Use a conservative estimate here to protect yourself from market fluctuations.

- Bond returns. Enter your average expected rate of return on the bonds and fixed rate assets in your portfolio. The average fixed income return for the last 150 years was 2.4%, but—like stocks—that does not mean that will hold true into the future. Use a conservative estimate here as well.

What's a good target withdrawal?

If you're worried about draining your retirement too fast, you're not alone. It's a top of concern of people nearing retirement, and it often leads to people delaying their retirement out of fear their money won't last.

There are a few variables at play that should be considered when picking your target withdrawal rate. Generally, a 4% withdrawal rate is considered safe for a 30 year retirement. Still, it's a good idea to understand what could make a more conservative withdrawal rate like 3% more desirable for you. Here are some things to consider:

- Life expectancy. The standard retirement length is about 30 years, so most advice centers around this length of retirement. If you're retiring early, or planning for a longer life expectancy, a more conservative number might be better for you.

- Inflation. Inflation shrinks your purchasing power each year, so in retirement you'll need to increase your spending each year to get the same amount of goods and services as the previous year. In the years where your portfolio performs well, it's probably okay to withdraw more to overcome inflation, but in the years your portfolio does not perform well, it's a good idea to cut back on your expenses.

- Health costs. With age comes increasing health costs, so it's important to consider those additional expenses you may encounter later in life.

How should I allocate my portfolio?

This is largely a personal opinion based on your appetite for risk, but a good rule to follow is the 110 Rule, which states you should subtract your age from 110, and the result is the percent of your portfolio that should be made up of stocks. So, for a 35 year-old, their portfolio would consist of 75% stocks.

If your stock percentage is too high or too low, you run the risk of running out of money in retirement. If you have too much in stocks, volatile markets may strike at the worst time. If you have too much in bonds, your returns will not be able to keep up with inflation. When you're younger, you have the ability to ride out downturns more effectively, which is why the 110 rule suggests higher stock holdings for younger people.

As you can see, there are a lot of variables at play when it comes to retirement, so getting a clear picture of your finances and cash flow is a crucial first step to setting yourself up for success. Monarch is helping thousands of households navigate their financial life and achieve peace of mind.