It used to be the case that buying a home offered almost guaranteed savings and long term financial gains. Most Americans defaulted to purchasing property. However, the times have changed—the choice to buy a home versus rent is now a bit more complicated.

As housing prices increase, interest rates rise, and affordable homes grow scarce, buying a home is increasingly difficult for many Americans. The home ownership rate among young adults (under 35) has decreased from 45% in 1990 to 41.5% in 2021. According to Bankrate’s Home Affordability Study, most Americans now need a six-figure salary to afford a median-priced home. It’s no surprise that buying a home feels increasingly out of reach for many people.

With all this in mind, it might feel like a no-brainer to stick with renting. Yet rental properties come with their own set of drawbacks and restrictions. Deciding whether to continue renting or buy a home is ultimately a personal decision.

In this article, we’ll look at the pros and cons of renting versus buying. We’ll also walk through the factors that should go into your decision, everything from finances to the emotions attached to owning your home. Then, we’ll wrap up by addressing the question: does it make more sense to rent or buy?

Renting vs. buying: Pros and cons

To start, weigh the pros and cons of each scenario against your goals and current finances. The expectations and responsibilities of a renter are quite different from those of a homeowner. Everything from your lifestyle to inflation should factor in. At a high-level, here are the pros and cons of renting versus buying.

Renting: Pros and cons

Pros

- You’re not responsible for maintenance and repairs.

- Fluctuations in mortgage interest rates and home prices isn’t a concern.

- You have greater flexibility in where you live.

- There are fewer upfront costs (usually first month, last month, and a security deposit. In some cases you may also pay a broker’s fee).

- You’re not responsible for property tax or homeowner’s insurance.

- You’re free of debt by avoiding a mortgage loan.

- Rent is often the most money you’ll pay toward housing.

Cons

- You’re subject to your landlord raising rent.

- You have to navigate complicated and competitive rental markets.

- There is less freedom to make alterations to the rental.

- You do not build equity.

- You may have to move on short notice if the landlord sells the property.

Buying: Pros and cons

Pros

- You might build equity.

- You don’t have a landlord.

- Owning a home can offer more stability.

- You can make any changes to your home, within the laws of your local jurisdiction or HOA guidelines.

- You can eventually own your home outright.

Cons

- You have to pay a lot of money up front.

- The mortgage loan amount is the least amount you’ll pay.

- You’re responsible for utilities, home repairs, and maintenance.

- You risk losing money if the value of your home declines.

Where you live impacts home affordability

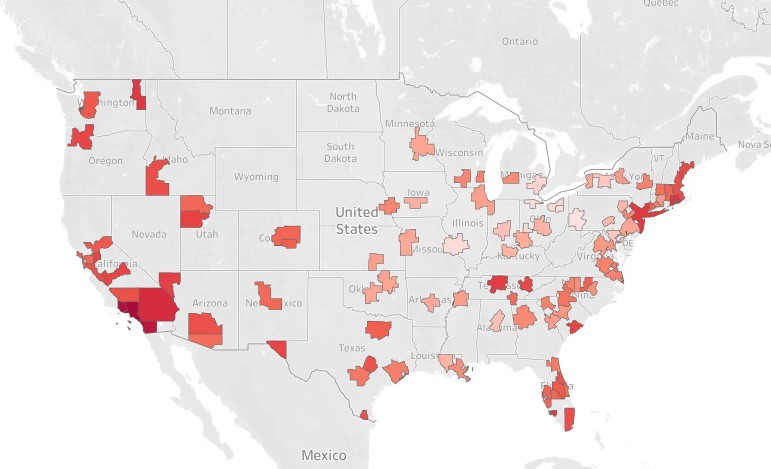

Where you live influences whether it’s a better choice to rent or buy. In most mid-to-big cities, the cost of home ownership is high enough that it’s usually cheaper to rent. The illustration below captures hotspots where renting may be more affordable than buying.

In most major cities in the United States, the monthly rent is cheaper than the mortgage payments (Source).

In the past, it was cheaper to have a monthly mortgage no matter where you lived. However, over the last few years, as interest rates rose with fewer homes on the market, it’s now generally more expensive to own a home in most large metropolitan areas.

As you consider the financial implications of home ownership, make sure you factor in your city and state. You can use a mortgage calculator to get an estimate of what you might need to pay each month if you opt to buy a home in your location.

5 personal factors to consider

1. It may be a personal goal to own a home

For some, buying a home is a personal life and financial goal. It’s viewed as a way to build wealth as well as put down roots in a place you see yourself staying for the long term.

When you own a home, you’re free to decorate it to reflect who you are. You can plaster the walls with bright wallpaper, build a robust garden, or even tear down a wall. Plus, one day, after making consistent payments, you’ll own your home outright. You’re then free of mortgage payments entirely (though you are still responsible for insurance and taxes).

2. You seek the stability of home ownership

Owning a home means you’re not subject to rising rent prices. At the same time, the value of your home changes with market fluctuations. Although the value of homes generally trends up, large economic downturns or housing market shifts can slow, stop, or reverse that growth.

Additionally, inflation is a reality. It climbed to 7% in 2021 before falling to 3.4% in 2023. Inflation impacts both mortgage interest rates and rent prices. The more it costs landlords to live and run the property, the more renters pay. In other words, the costs get passed on to the renter.

Home ownership solidifies the amount of money you put toward your mortgage each month. Whether inflation stays around 3-4% or leaps to 7%, you pay the same amount if you have a fixed rate mortgage.

However, your property tax can increase year-over-year, but most counties have a maximum on how much it can be raised each year. For example, the Oregon Constitution states property tax can’t increase more than 3% each year unless there are large changes made to the property. Additionally, insurance costs can rise — a phenomenon occurring in areas prone to severe weather events.

3. You’re looking to build equity

If you have a healthy retirement and emergency savings, along with a lump sum of cash you’ve been saving for a down payment, buying a home is a chance to build equity.

Unlike many other purchases, property generally appreciates overtime. As of February 2024, the year-over-year home appreciation averages at 5.5%. Remember, there are plenty of external factors that impact this growth. The average rate of appreciation doesn’t translate to guaranteed future home value.

For some, buying a home can feel like the most economical way to invest money. You also live in it. So the home doubles as a (potentially) appreciating investment and your living space.

At the same time, there is financial risk to home ownership. Because the home’s value is subject to the ups and downs of the market, there is a chance it won’t earn you money by the time you need to sell. Additionally, when you sell your home you still have to find a place to live.

4. Buying a home fits into your current financial state

Your current finances play a massive role in whether you buy or rent. Factors like having an emergency savings account, retirement savings, and stable income all impact your ability to make the mortgage payments.

As a general rule of thumb, your emergency savings account should have three to six months’ worth of expenses. Your average cost of living will most likely rise after you purchase a home.

Keep this in mind: The mortgage is the least amount you’ll pay towards housing expenses. As a homeowner, you’re responsible for managing utilities, home insurance, and property taxes. Additionally, there are always little breaks or issues that need attention. Your garbage disposal may break so you have to call a plumber. Or your basement springs a leak after a big rainstorm. You’re on the hook for all of this, so having a nest egg of savings to handle these unexpected expenses is crucial.

You may have heard the saying, “house rich, cash poor.” It refers to someone who placed most of their liquid cash into the property. Now, the majority of their net worth is wrapped up in their home. In most cases, it’s not a good idea to buy a home that will make you feel financially strapped month to month.

5. You want to avoid debt

Debt doesn’t sit well with everyone. Sometimes, the idea of owing a lender a large amount of money that accrues interest is uncomfortable. Because home loans are amortized, you spend the first 15 or so years of the mortgage mostly paying off the interest.

Overtime, you gradually start paying less toward the interest and more toward the principal. Depending on your financial situation, there are options for paying off your mortgage earlier, but it’s not always the most effective use of money.

If you have a history of trouble with debt or dislike the idea of having it, you might feel better to stick with renting. Some people opt to invest the money they could put toward a downpayment. The S&P 500’s average rate of return is 8%. There is potential for large gains over 30 years, the average length of a mortgage loan. Plus, it could afford you greater peace of mind.

Wrapping Up: Does it make more sense to rent versus buy?

As you may have guessed, there is no single answer to whether you should rent or buy. The choice is often rooted in personal finances, but money is far from the only factor you’ll consider.

Ask yourself the following questions as you brainstorm what’s best for you:

- Is owning a home a personal goal? Am I feeling pressure to buy a home because it’s what I’ve been told I should do?

- Am I purchasing the home alone or with a partner? How does this change the respective financial obligations?

- Do I have a comfortable emergency savings account, a reliable income, and the ability to pay for unexpected home repairs as needed?

- Do I feel comfortable with owing money to a lender?

- Am I set on staying in a single place for an extended period of time? Where am I hoping to buy a home?

- What is the most effective way for me to build equity?

Your finances and goals likely shift overtime. If buying a home doesn’t feel like the right choice now, you can change your mind and purchase one later. But if you doubt it’s the best option for your situation, you can still grow your wealth by investing funds elsewhere. Both are viable options for your personal finances.