For most of us, owning a home means checking off a huge life milestone. But purchasing property comes with its own set of logistics and considerations. Top among them: how you should handle paying off your mortgage.

Whether you’ve been living in your home for two years or 20, you’ve probably wondered whether or not you should pay off your mortgage early.

As a rule of thumb, if your mortgage interest rate is less than the rate of return you can expect from investing the money, you’ll often gain more by investing.

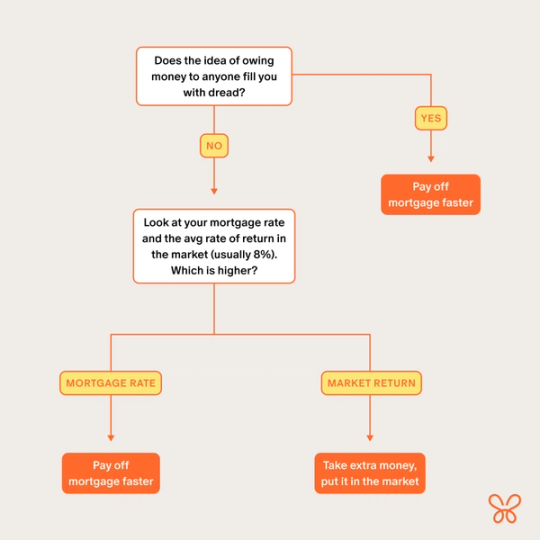

However, there’s no one-size-fits-all approach to decide to pay off your mortgage. It boils down to financial goals, history with debt, and even personal preference — some people just feel more comfortable when they own their home outright.

With several factors to consider, it can quickly feel overwhelming. But fear not, we’ve gathered all the factors you should consider below. Let’s dive in.

Should you pay off your mortgage? Start with the math.

At first glance, keeping the money you would usually spend on a mortgage in your pocket each month feels like an opportunity for big savings. Plus, you fully own your home. But it’s not quite that simple.

To start, there are a few different expenses nestled within your overall mortgage payment:

- Interest: The fee you pay to the lender (bank) is a percentage of the total loan.

- Principal: The amount of money you borrowed to buy the home.

- Property taxes: A fee based on a percentage of the home’s value.

- Insurance: Homeowner’s insurance is required by most lenders.

When you pay off your mortgage, you’re taking care of the interest and principal portions. That means you’re still on the hook for property taxes and insurance. Without a mortgage, you pay these fees directly to the local government and insurance company.

That said, there are two options for how to tackle paying off your home’s interest and principal earlier than the term of the loan:

Example A: Paying off your mortgage all at once

You’ve purchased a home, and after the down payment you have a 30-year loan for $200,000 with 5% interest. If you stay the course, making the monthly $1,074 payment for 30 years, you’ll have paid $186,512 in interest. In the end, your loan amounts to $386,512.

Let’s say 15 years of making payments go buy and you have enough extra cash to pay off the mortgage in full. Your remaining principal balance is $135,259.87. Here’s how it plays out if you pay off the mortgage early versus invest the same amount as a lump sum:

If you pay off your mortgage early…

- Look into potential prepayment penalties for early mortgage payoffs, but more on this later.

- Take the $1,074 you save each money by paying off your mortgage early and invest it.

- After 15 years (180 months) of investing $1,074 per month, you’ve invested a total of $193,320 (180 x $1,074 = $193,320).

- With an average return rate of 8%*, your total investment account balance after 15 years is $349,936.44.So, should you pay off your mortgage early and invest the money you would’ve put toward your mortgage, your grand total at the end of 15 years is $349,936.44.

- Subtract your total invested amount ($193,320) from the investment account balance after 15 years ($349,936.44) and your total earning is $156,616.44.

If you invest the money...

- You continue paying off the mortgage as planned and invest the $135,259 you were going to use to pay off your mortgage and instead put it into the market as a lump sum. (Note: the following calculations assume you invest as a lump sum and no more.)

- After 15 years (180 months), the total balance in your investment account is $429,064.42.

- Subtract your initial investment amount ($135,259) from the balance after 15 years ($429,064.42) and your total earning is $293,805.42.

In the scenario where you invest the lump sum instead of paying off the mortgage, you earn more money than if you opt to gradually invest over 15 years.

Bear in mind that these numbers will change depending on your situation and investment decisions. Yet, the calculations remain the same. Simply swap out the sample numbers for your loan amount, mortgage interest rate, remaining years left on the loan, and average return rate of where you plan to invest your funds. Use a calculator to adjust all of the needed variables.

Curious how your down payment factors in? The down payment is your initial investment in the home. It might factor into your calculations if you pay private mortgage insurance (PMI). In most cases, people whose down payment is less than 20% of the price of the home will pay PMI. Take this into consideration as you calculate how much money you’ll save by paying off the mortgage early. Certified Financial Planner Brandon Galici mentioned a caveat, “Paying off your mortgage so that you have at least 20% equity could eliminate this monthly PMI expense.” Depending on your PMI rate, this could be an opportunity for good savings.

All told, there is so much more that goes into deciding whether or not to pay off a mortgage than just the numbers. Personal preference and wanting to avoid debt are among the long list of reasons that may factor into your decision. We’ll touch on all of them a bit later.

Here’s a tip: Depending on your lender and when you want to pay off the mortgage, you could be subject to a prepayment penalty. It’s rare, but it’s possible. You can ask your lender for a payoff quote to get a sense of how much it will actually cost to pay off the loan. Galici commented on prepayment fees saying, “typically, these prepayment fees last the first three to five years of your mortgage.” But, again, it depends on your lender.

Example B: Making extra payments to pay off your mortgage early

In this scenario, let’s say that since you’ve purchased your home you’ve received a raise. Good job! Now, after 15 years of making regular mortgage payments, you have an extra $250 per month and you’re wondering if the best use of those funds is to continue chipping away at your mortgage.

You have a 30-year mortgage loan for $200,000 at a 5% interest rate. Your monthly payment toward the mortgage is currently $1,074. Here’s how it plays out if you pay off the mortgage early versus invest the same amount as a lump sum:

If you put the extra cash toward your loan...

- You put the extra $250 per month toward your principal. Now, your total mortgage payment increases to $1,324.

- By accelerating your mortgage payoff in the last half of the loan, the total cost of the loan drops from $386,513 to $370,740.

- You save $15,773 and your home is paid off three years and nine months early.

If you invest the extra cash...

- You opt to stick with your regular mortgage payments of $1,074 per month and invest $250 per month.

- Your total contributions to the investment account over those 15 years amounts to $45,000 (180 x $250 = $45,000).

- After 15 years (180 months) of investing $250 per month at an 8% interest rate, you have an investment account with $81,456.34.

- Subtract your total contributions ($45,000) from the investment account balance at the end of 15 years ($81,456.34).

- Your interest earned off the investment account totals $36,456.34.

Pro tip: Use a compound interest calculator to get a sense of how your investments would play out for the various scenarios. Additionally, mortgage payoff calculators can be helpful assets when deciding whether or not to pay off the loan.

In summary

When calculating whether or not you should pay off your mortgage, compare your current mortgage interest rate with the expected rate of return for where you place your money:

- If your mortgage interest rate is less than the rate of return, you’ll often gain more by investing.

- If your mortgage interest rate is more than the rate of return, you’ll often gain more by accelerating your mortgage payoff. However, if the current mortgage interest rate is less than your mortgage interest rate, it could make more sense to refinance. (Tip: it usually doesn't make sense to refinance if the difference in rates is less than 1%, unless it’s a streamline refi, where .5% is your benchmark). After refinancing, you can reconsider paying off your mortgage in full or make additional monthly payments.

In the examples above, you earn more by investing in the S&P 500. But the return on investment changes based on where you opt to put your money.

For example, often the highest rate of return you can get from a high-yield savings account is 5%. While you earn less return than the S&P’s 8%, you may feel more comfortable placing a large amount of money in a savings account instead of investing. Additionally, you may decide to add money to an existing investment account, which increases your earnings overtime.

Your personal financial preferences, goals, and current setup matter here.

All these pen-and-paper calculations cover one angle of deciding to pay off your mortgage or not. Yet, for most people, there’s more to think about. You need to consider everything from your long-term financial goals to your personal feelings toward debt as well as the amount and interest rate of other existing debts you have. If you were taking the federal mortgage tax deduction, that’s another factor.

According to Galici, “In order to receive a tax deduction for mortgage interest, you need to itemize your deductions. According to the Tax Foundation, only around 10% of households itemize after the Tax Cuts and Job Act.”

All this to say, there are several moving parts that play into your decision. You can’t attach a number to a desire to own a home outright.

Some people opt to pay off their home regardless because they like the idea of owning their home outright and being free of debt. It’s important that you make the best decision for your personal preferences.

4 additional factors to consider

1. Mortgages are amortized

Like most other types of loans, mortgages are amortized. That means for the first 15 years, you spend more money toward the interest. Over the course of a 30-year mortgage, you gradually pay less toward the interest and more toward the principal.

The lower your principal balance, the less interest you pay. And the sooner you pay off your mortgage, the less interest you pay.

Again, the exact numbers here vary based on your situation. An amortization calculator is helpful when understanding exactly how much money you’ll spend on a year-by-year basis.

2. You’re still responsible for other house-related payments

As mentioned above, you’re still responsible for your home’s insurance and property taxes even after the mortgage is paid off. Be sure not to exhaust all of your liquidity to pay off your mortgage as you will still need to make insurance and tax payments.

In most cases, you pay the bank a lump sum for your mortgage. The property tax and insurance costs are baked into that total. As a result, the bank makes those payments for you.

However, with your loan paid off, the bank is no longer a middleman. You are now responsible for paying insurance and property taxes to the respective parties.

3. Personal Finances

Part of deciding whether or not to pay off your mortgage is taking a close look at your personal finances. Here’s what you need to assess:

- Is the majority of your net worth tied up in your home? It’s often wiser to diversify your investments across different asset classes instead of using all of your available cash to pay off your home.

- What is your past experience with debt? If you have a fear of debt or feel it’s a burden, paying off your mortgage early can give you peace of mind, no matter what the numbers tell you.

- How will you utilize the extra funds if you choose to not pay off your mortgage? If you’ll experience a greater return by investing those funds or if you have other debt with higher interest rates that you could pay off first, it might not make sense to pay off your mortgage early. Some people may feel more comfortable placing that money in a high-yield savings account that is FDIC insured. This is where honesty with yourself is important. It’s easy to say you’ll invest that extra $250 each month. We suggest setting up automatic deposits from your paycheck into your investment account (and then actually invest that money. Don’t forget!).

- Do you have a big enough emergency fund? 93% of Americans have faced a financial emergency at least once. Ideally, you have three-to-six months’ worth of living expenses saved up as a safety net for these emergencies. If you don’t have a healthy emergency fund, you may create more financial risk by putting more money into the house.

Overall, you need to compare your current financial stability against how your finances will look should you opt to pay off your mortgage. Always take the route that affords you the greatest stability and net worth, without jeopardizing your financial health.

4. Personal goals and values

It’s one thing to look at the numbers on paper. But it’s another to think about your personal feelings toward home ownership, debt, and long-term finances.

For some individuals, the idea of fully owning their home is a source of comfort and pride. It may be a relief to not have to make monthly mortgage payments. You might feel adverse to debt or have a history of negative experiences regarding loans.

Regardless of motives, owning your home outright affords you peace of mind. You can focus your attention on achieving other financial goals without the burden of debt.

Pros and cons of paying off your mortgage early

Determining whether or not to pay off your mortgage is complex, but not impossible. At a high level, these are the pros and cons of wrapping up your mortgage ahead of schedule:

Pros:

- By not paying as much toward your mortgage, you have more cash on hand to invest, place in a high-yield savings account, or spend elsewhere

- You have the comfort of owning your home outright

- You might save thousands of dollars in interest or mortgage insurance payments

- You’re free of debt

Cons:

- You can no longer claim the federal mortgage interest tax deduction if you’re currently itemizing deductions

- You might miss the chance to gain better returns by investing elsewhere

- The value of your home is subject to market fluctuations, so you might not make as much as you put into it if you need to sell quickly

- You have less cash on hand for emergencies or large purchases

Conclusion

Determining whether or not to pay off your mortgage is a big decision. Consider your personal finances, long-term investment goals, and emotional relationship with home ownership. In doing so, you can feel confident that you’re making the best decision for you.

*Over 66 years, from 1957 to 2023, the average annual return of the S&P 500 is 10.26%. However, because we’re looking at the gains over 15 years, we’ve opted for a more conservative 8% when doing our calculations.