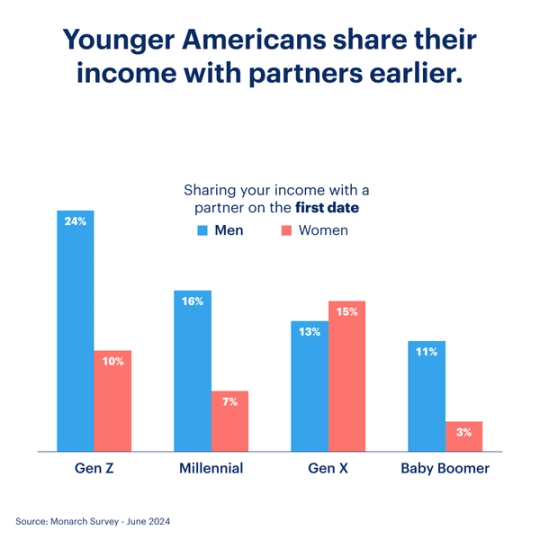

In June 2024, Monarch surveyed 1,000 Americans about various money beliefs, especially in regard to dating, relationships, and marriage. In the coming weeks, we’ll be sharing insights from that survey.

Today we’re focusing on an age-old dating question: When is it appropriate to candidly and transparently discuss salary and income levels with your romantic partner? The answer, it turns out, depends on your age.

Some key findings:

- Young men are much more likely to share their income levels: 8% of men want to discuss income on the first date. But for Gen Z men, the number is 24%.

- Young women are also more likely, though not as much: 7% of women want to discuss income on the first date. But for Gen Z women, the number is 10%.

- Older women are more likely to want to wait before revealing their income: 14% of Baby Boomer women prefer to wait until they are engaged to discuss finances.

We’ve written previously about the importance of being aligned with your romantic partner when it comes to spending goals and money habits.

“The more we normalize talking about money, the more comfortable younger generations will be to talk about it,” says Rachel Lawrence, Monarch Head of Advice and Planning.

Aside from being more comfortable with sharing their income, Gen Z is more comfortable with discussing how much each partner spends for saves. Baby Boomers most commonly say the best time is “after more than three months of dating” (28%) while Gen Z most commonly say the best time is “after three dates” (29%).

Not only do younger Americans share financial info earlier, they do it more often. 33% of Gen Z (men and women) think you should discuss financial goals with a partner weekly. That number decreases to 26% for Millennials, and continues declining to 14% for Baby Boomers.

One possible explanation for the trend is – say it with us now – social media. You can easily look up where someone works, what someone does for a living, where they spend their money, where they go on vacation.

Another explanation is that younger Americans are less likely to feel prepared for the future, so they lean on their peers to suss out where they stand and where to improve. According to a Gallup poll 76% of Gen Z said "they have a great future ahead of them." However, only 44% reported feeling prepared for it.