Monarch is launching in November. Here’s a preview of what makes it different.

Over twelve years ago, I was part of the original team that built the personal finance application Mint.com.

Mint was pretty novel when it launched. For the first time, people could see all of their financial accounts and transactions connected in one place and updated automatically. For many users, this was transformative.

As the first product manager on the Mint team, I would often have conversations with our users to understand how they were using Mint, and what we could do to make it better.

These calls were humbling.

One person told me about how they could finally walk into a grocery store without having a panic attack over the fear of bouncing a check. Another credited Mint with saving her marriage, because she and her husband had finally stopped fighting about money.

Over the course of many such calls, a few things became abundantly clear:

No matter your financial situation, managing your money can feel complicated and stressful

The right software can reduce your financial stress and increase your sense of control

Improving your relationship to your finances often yields dramatic improvements in other areas of your life

Introducing the next phase of personal finance software.

Mint was ultimately acquired by Intuit in 2010, just two short years after our launch.

In the ensuing ten years since the Mint acquisition, we have seen an explosion of financial technology (or “fintech”) companies. These companies have introduced new ways to help people manage investments, bank through their phones, get loans, and even buy houses.

Despite this proliferation of fintech, there has been surprisingly little innovation in personal finance software. Even in 2020, people tend to stitch together a bunch of different apps or rely on DIY spreadsheets in an attempt to get a holistic view of their finances.

Personal finance software can and should do more. After being frustrated by this for many years, Jon, Ozzie and I decided to do something about it and started a new company named Monarch, after the Monarch butterfly. We chose this name because we’ve seen how the transformation from being financially stressed to financially empowered can be just as liberating and profound as a caterpillar’s transformation from crawling to flying.

For the past 18 months, our passionate team has been hard at work building the personal finance platform that we wish existed. And now it’s nearly ready to take flight.

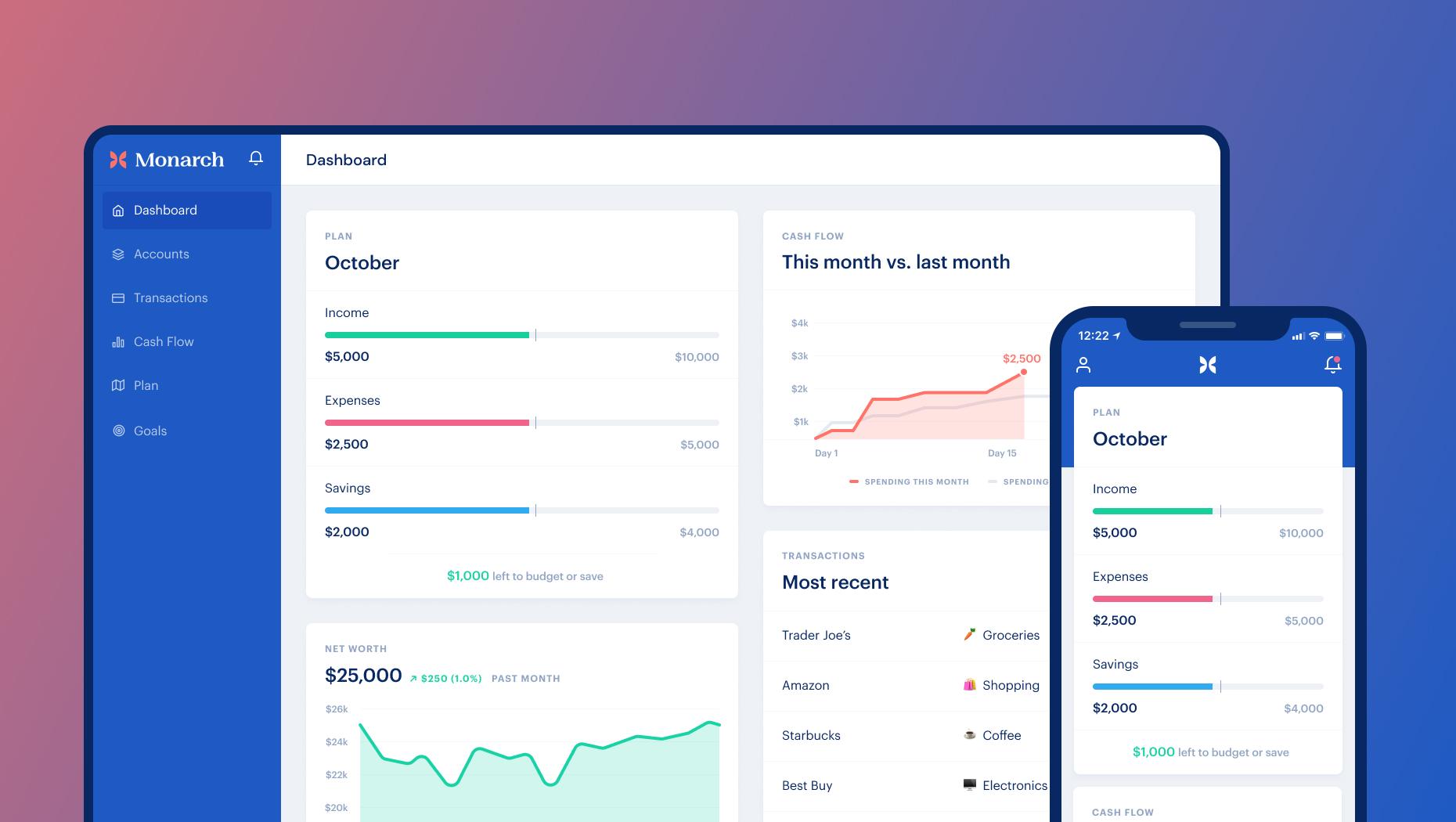

While Monarch will of course help you with all of the personal finance “basics” you’ve come to expect—services like account aggregation, budgeting, and auto-categorization of spending—what is exciting about Monarch is what makes it different.

Today, I’m offering a preview of just a few of the things that will make our product transformative.

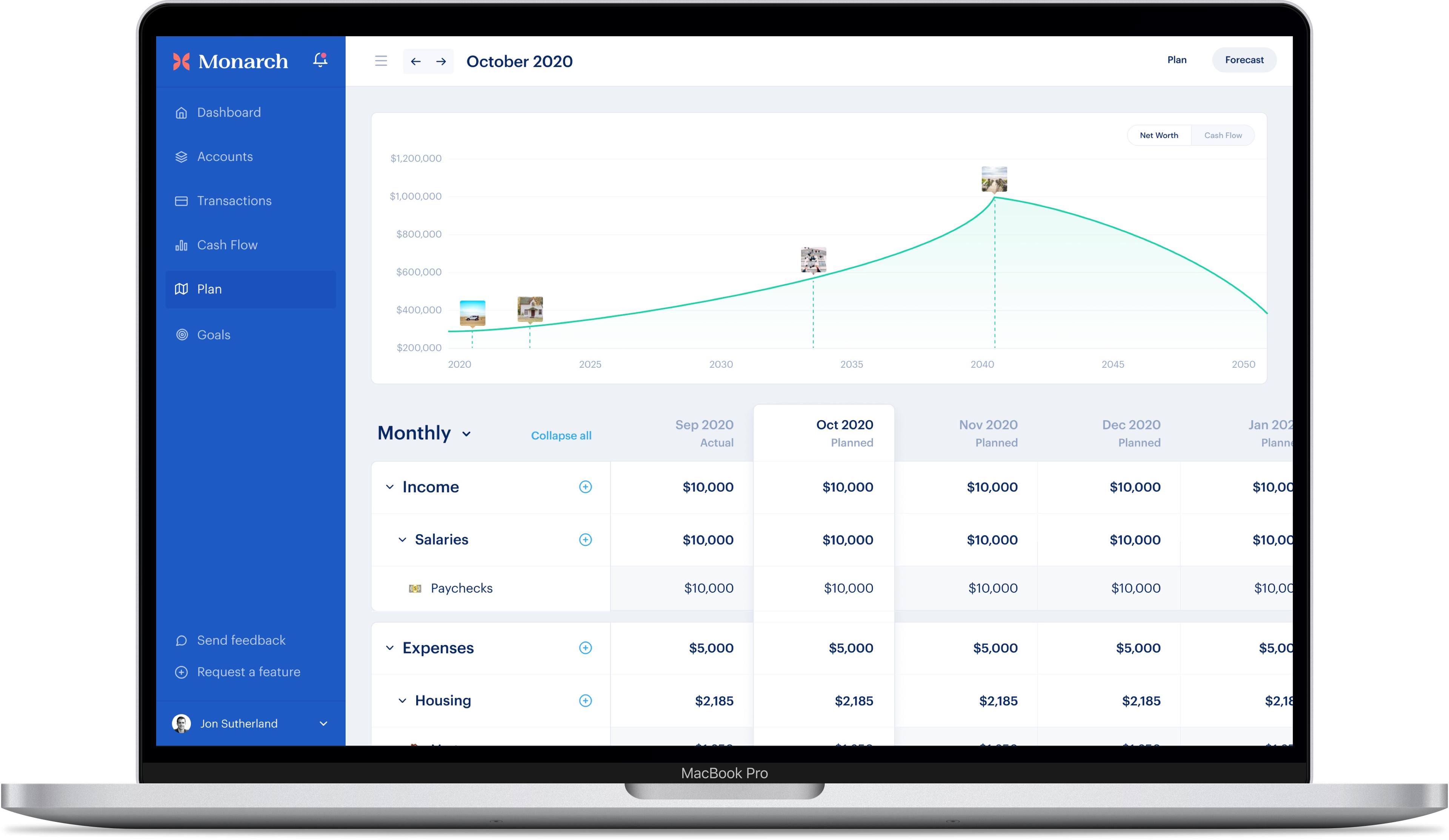

Monarch will give you a step-by-step financial plan based on your goals for the future.

Studies show that when you can see a clear path towards achieving your goals, you’re much more likely to be successful. With this in mind, we’ve built Monarch to help you create a detailed financial plan that can automatically project how different spending and savings scenarios will affect your financial goals. We want to help you see the future, so you can make informed decisions now.

Monarch will empower you to adopt healthier financial habits.

Using a research-based approach, Monarch will show you how your short-term financial behaviors directly influence your financial health. With this information, you can make educated decisions in the moment and see exactly how your choices affect your future. For the first time, you’ll have a sense of clarity when it comes to how your financial habits are actually affecting your life—so you can change what’s not working, and do more of what’s serving you well.

Monarch is a mission-driven company with a transparent business model.

Our mission at Monarch is to help people improve their financial lives. We feel strongly that the best way to do that is through a subscription-based business model. This may seem unconventional in an era when most personal finance products are “free” and supported by advertisers. However, charging a subscription aligns our incentives with yours and enables us to exclusively focus on improving your financial life, rather than catering to the needs of advertisers. It also means that we will never clutter our product with ads, try to sell you a credit card you don’t need, or auction off your financial data to the highest bidder.

Monarch is launching in November. Sign up to be notified at https://www.monarchmoney.com. It will first be available on web and iOS, with an Android app to follow. It will offer users a 7-day free trial, and then will be priced at $9.99 per month or $89.99 per year.

We are just getting started, but have exciting plans for the coming months and years. We hope that you’re as excited as we are about a new era of financial transformation!